The South African Reserve Bank (SARB) remained on hold at the monetary policy meeting held Thursday, underlining weak domestic currency amid heightened risks from global uncertainty. Also, inflation remained below the central bank’s target range, compelling it to further not raise interest rates.

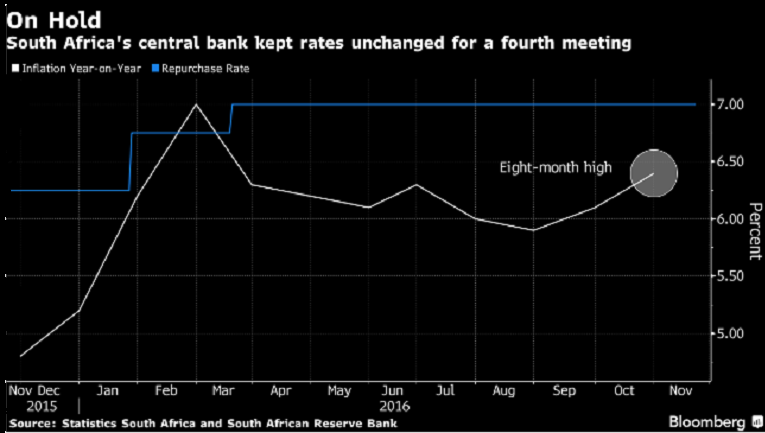

The six-member monetary policy committee (MPC), chaired by Governor Lesetja Kganyago, unanimously decided to take the neutral move; also, it did not discuss a rate cut move, nor did any of the members urge for a hike in the meeting. The MPC has remained on hold since the since March after raising it by 200 basis points since 2014 in a bid to limit price growth to between 3 percent and 6 percent.

Despite inflation picking up to an 8-month high to 6.4 percent in October, it is estimated to slow with the central bank’s target band of 3-6 percent by the second quarter of 2017. The MPC forecasts inflation will peak at an average of 6.6 percent this quarter and slow to 5.8 percent next year and 5.5 percent in 2018.

Moreover, the rand dropped to its lowest level, following news of President-elect Donald Trump’s victory in the 2016 US presidential election, on risks of a rise in government expenditure that could instigate a series of US interest rate hikes, posing serious downside risks to the import-dependent South African economy.

However, the SARB kept its economic growth forecast for the year unchanged at 0.4 percent. Output will expand at 1.2 percent in 2017 and 1.6 percent the year after, according to the MPC. Also, the rand will follow a volatile nature, in relation to the Federal Reserve decision in December. Although markets have fully priced in for a rate hike next month, uncertainties still prevail for South Africa.

Meanwhile, Moody’s has rated South Africa’s foreign-currency debt at two levels above junk, with a negative outlook, while S&P Global Ratings is yet to publish it outlook on December 2, but possesses a similar view with the lowest investment-grade level.

Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns

Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns  Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility

Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility  RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says

RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says  Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm

Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm  Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady

Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady  Asian Markets Surge as Japan Election, Fed Rate Cut Bets, and Tech Rally Lift Global Sentiment

Asian Markets Surge as Japan Election, Fed Rate Cut Bets, and Tech Rally Lift Global Sentiment  Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons

Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons  Trump Endorses Japan’s Sanae Takaichi Ahead of Crucial Election Amid Market and China Tensions

Trump Endorses Japan’s Sanae Takaichi Ahead of Crucial Election Amid Market and China Tensions  BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook

BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook  Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target

Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target  Gold and Silver Prices Slide as Dollar Strength and Easing Tensions Weigh on Metals

Gold and Silver Prices Slide as Dollar Strength and Easing Tensions Weigh on Metals  Yen Slides as Japan Election Boosts Fiscal Stimulus Expectations

Yen Slides as Japan Election Boosts Fiscal Stimulus Expectations  Nikkei 225 Hits Record High Above 56,000 After Japan Election Boosts Market Confidence

Nikkei 225 Hits Record High Above 56,000 After Japan Election Boosts Market Confidence  Silver Prices Plunge in Asian Trade as Dollar Strength Triggers Fresh Precious Metals Sell-Off

Silver Prices Plunge in Asian Trade as Dollar Strength Triggers Fresh Precious Metals Sell-Off