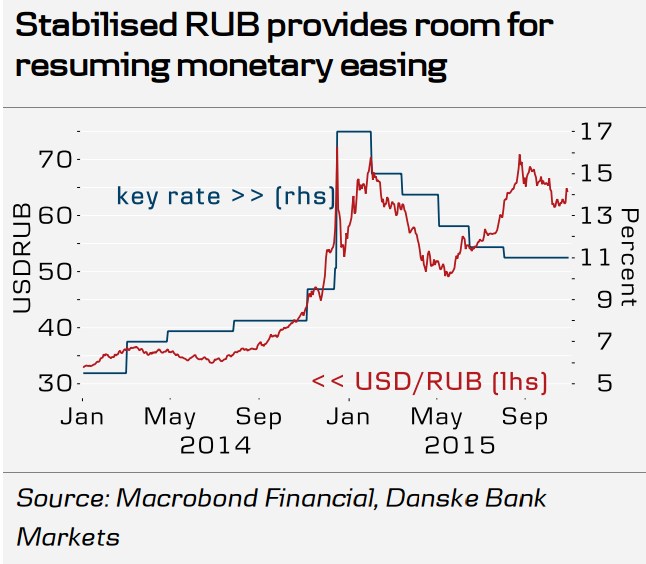

Russia's central bank (the CBR) will announce its monetary policy decision this friday at 11.30 CET. The key rate is expected to be lowered by 50bp to 10.50%, while consensus is split between a 50bp cut and no change. It is believed that the CBR will resume its monetary easing after a pause in September 2015, as inflation acceleration has stopped after a marginal rise in August 2015 when Chinese woes weighed on the RUB and consumer prices.

At the same time, the RUB posted 3.1% in spot returns against the USD in the 30 days to 28 October, gaining on better news from China and markets' expectations on a postponement to Fed hiking. Together with the stabilising oil price, these factors reduced the RUB's volatility and provided additional room for resuming monetary easing, which has been badly missed by businesses and consumers among the current economic recession.

We saw the latest statement released after September's decision being cautiously dovish despite unchanged rates as Russia's economic prospects look weak. Yet, cautiously trying to justify its latest 'on hold' decision, the CBR did not clear enough anchors to the markets. The CBR left an open question: are inflation expectations more important in the CBR's decision making than economic cooling? This was a change from its previous communications, which enhanced the importance of economic risks and less inflation.

"We believe that political pressure on the CBR to cut rates has increased and the central bank's attention will be drawn away from inflation expectations at its next meetings", says Danske Bank.

Russia’s central bank to cut the key rate by 50bp

Thursday, October 29, 2015 8:49 PM UTC

Editor's Picks

- Market Data

Most Popular

MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks

MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks  Bank of England Expected to Hold Interest Rates at 3.75% as Inflation Remains Elevated

Bank of England Expected to Hold Interest Rates at 3.75% as Inflation Remains Elevated  Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons

Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons  Fed Confirms Rate Meeting Schedule Despite Severe Winter Storm in Washington D.C.

Fed Confirms Rate Meeting Schedule Despite Severe Winter Storm in Washington D.C.