Sweden's Riksbank held its key benchmark repo rate at -0.5% and also made no changes to its Quantitative Easing program at a policy meeting held today. The Executive Board has assessed that there “will be a longer delay until the repo rate begins to be raised" on account of uncertainty over Brexit.

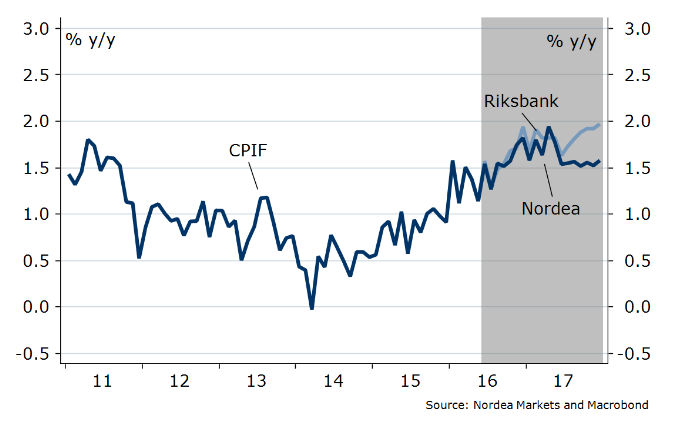

The Riksbank has revised down its macro projections for growth and inflation for next year. It expects CPIF inflation to average 1.5 percent in 2016 and 1.8 percent in 2017, as compared with the earlier forecasts of 1.4 percent and 2 percent respectively. The economy is now projected to grow 3.6 percent this year and 2.2 percent next year, downwardly revised from 3.5 percent in 2016 and 3 percent in 2017.

In a statement that followed the Riksbank said ‘the Swedish economy continues to strengthen, but that there is "considerable" uncertainty" over developments abroad’. The Riksbank projects that the global economic activity to grow; however, at a decelerating rate as compared to earlier forecasts. It said that a highly expansionary monetary policy is needed to provide support to the Swedish economy and rising inflation and that the bank stands ready to ease if this is needed to safeguard the inflation target.

Riksbank stated that the domestic economic activity has strengthened rapidly and that inflation is witnessing a rising trend. Economic activity is likely to improve, which in turn, creates conditions for inflation to continue accelerating, added Riksbank. Swedish inflation slowed more than estimated in May. After four years mainly spent below 1%, the Swedish CPIF bounced sharply to 1.5% at the beginning of the year, taking a step towards the Riksbank's 2% inflation target. Inflation in Sweden is unlikely to reach its target rate by end-2017, which should keep alive rate cut expectations.

"Our main scenario is that the Riksbank will stay on hold for the remainder of 2016 and even throughout 2017. However, as we don’t see that inflation will rise to the 2% target within the forecast horizon further easing measures cannot be excluded. Thus, we keep seeing that the risks are tilted towards more easing," said Nordea Bank in a research report.

SEK slips on the day after Riksbank held rates. EUR/SEK was up 0.47% at 9.4800, while USD/SEK was up 0.44% at 8.5555 at 1245 GMT.

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  Silver Prices Plunge in Asian Trade as Dollar Strength Triggers Fresh Precious Metals Sell-Off

Silver Prices Plunge in Asian Trade as Dollar Strength Triggers Fresh Precious Metals Sell-Off  Asian Currencies Trade Sideways as Dollar Stabilizes, Yen Weakens Ahead of Japan Election

Asian Currencies Trade Sideways as Dollar Stabilizes, Yen Weakens Ahead of Japan Election  Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty

Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  Dollar Steady as Fed Nomination and Japanese Election Shape Currency Markets

Dollar Steady as Fed Nomination and Japanese Election Shape Currency Markets  BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook

BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook