Two key developments are expected to shape Australia's monthly credit data for July. One is the beginning of a moderation in credit growth to housing investors as a result of regulatory pressure.

Banks have raised mortgage rates to such investors, and will also be more restrictive in their lending policy given warnings by the regulator (APRA) that banks which exceed the 10% guidance on maximum growth in this segment will be subject to special attention and potentially be forced to make additional provisions.

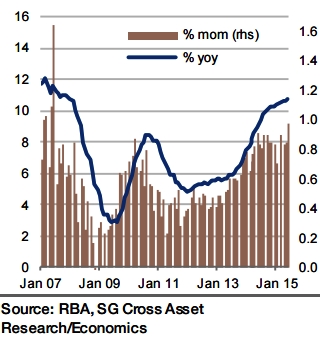

"This may begin to affect the data in July or in any case soon, after a particularly strong expansion in June (12.3% mom annualised). Two, some revival is expected in credit growth to businesses which has been weak for the last four months", says Societe Generale.

In light of recent legislation encouraging small investment activity through tax breaks, a pick-up in credit demand ought to materialise, and in any case rather optimistic about non-resource investment activity.

"As to the mainstay of credit growth, lending to owner-occupiers for house purchasing, steady growth of 5 -6% is expected in annualised terms. In short, easy monetary policy is expected to remain effective in supporting credit growth", added Societe Generale.

Regulatory pressure beginning to slow Australian housing investor credit

Monday, August 31, 2015 5:17 AM UTC

Editor's Picks

- Market Data

Most Popular

Gold and Silver Prices Rebound After Volatile Week Triggered by Fed Nomination

Gold and Silver Prices Rebound After Volatile Week Triggered by Fed Nomination  Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility

Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility  Lee Seung-heon Signals Caution on Rate Hikes, Supports Higher Property Taxes to Cool Korea’s Housing Market

Lee Seung-heon Signals Caution on Rate Hikes, Supports Higher Property Taxes to Cool Korea’s Housing Market  FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022  Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal

Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal  Australian Household Spending Dips in December as RBA Tightens Policy

Australian Household Spending Dips in December as RBA Tightens Policy