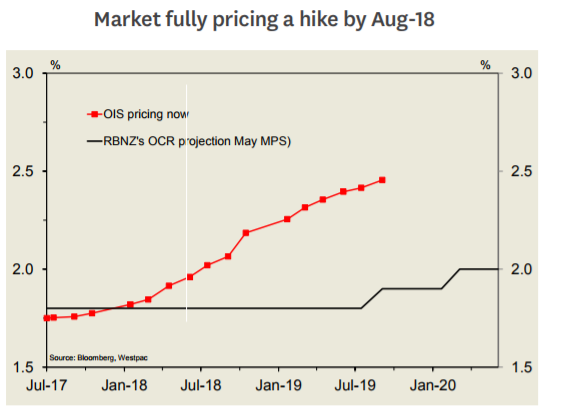

The Reserve Bank of New Zealand (RBNZ) is expected to hold its August interest rate setting meeting on Thursday, August 10, but it will be released on Wednesday at 2100 GMT. An Australian bank and financial-services provider, Westpac in its latest report said that the market pricing for the RBNZ has been fairly stable during the past week, a hike 100 percent priced in by August 2018.

It noted that they are less optimistic and expecting the official cash rate (OCR) to remain unchanged at 1.75 percent through next year. The central bank’s policy prescription remains the same: the economy needs to be allowed to continue to grow and gradually use up its spare capacity, in order for inflation to settle around the 2 percent target midpoint on a sustained basis, research note added.

And that means keeping official cash rate at record low levels for an extended period. As the CB starts to prepare its August Monetary Policy Statement, latest developments have generally been on the soft side: inflation was lower than predicted, the New Zealand dollar has risen, and the housing prices is falling much faster than the Bank expected, an Australian bank noted.

According to the Westpac, if the RBNZ was “firmly neutral” in its last review, it is hardly going to be mulling the timing of interest rate hikes this time around.

Meanwhile, FxWirePro launches Absolute Return Managed Program. For more details, visit http://www.fxwirepro.com/invest

BOJ Holds Interest Rates Steady, Upgrades Growth and Inflation Outlook for Japan

BOJ Holds Interest Rates Steady, Upgrades Growth and Inflation Outlook for Japan  RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist

RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist  Bank of England Expected to Hold Interest Rates at 3.75% as Inflation Remains Elevated

Bank of England Expected to Hold Interest Rates at 3.75% as Inflation Remains Elevated  Indian Refiners Scale Back Russian Oil Imports as U.S.-India Trade Deal Advances

Indian Refiners Scale Back Russian Oil Imports as U.S.-India Trade Deal Advances  Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady

Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady  Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility

Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility  China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices  Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns

Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns