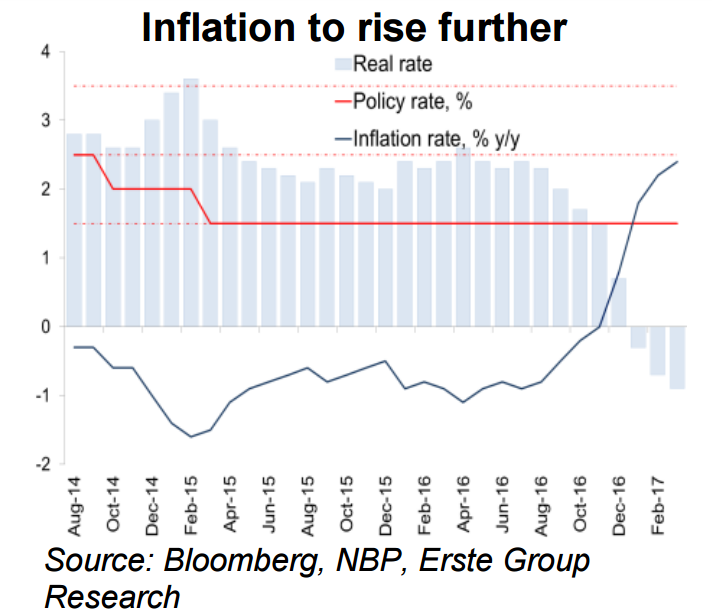

Poland March’s flash CPI inflation data is due Friday, and analysts expect Poland's inflation to rise further as base effects are still in place and are likely to push the number higher. Driven by a global acceleration in food and fuel costs, the annual index in Poland jumped to a four-year high of 2.2 percent in February.

Poland's inflation spiked close to the central bank’s target range almost immediately after a period of deflation. Data released last week showed Poland's unemployment rate dropped to 8.5 percent in February. Wages increased and household incomes rose by an estimated 8 to 9 percent which could put pressure on inflation. Higher wages raise the prospect that producers will look to increase their profit margins by keeping prices as high thereby pushing inflation higher.

That said, the country’s rate of inflation remains below the central bank’s targeted range of 2.5 percent. Also, core inflation has been close to zero and there is little threat that the inflation rate will overshoot the target in the medium term. While policy makers already revised their forecasts for inflation to 2 percent this year and next, they still see it below their 2.5 percent goal in 2019.

Based on minutes of the central bank’s March meeting, analysts expect rates will be stable in the coming quarters because inflation isn’t at risk of exceeding the central bank’s 2.5 percent target through 2019. Poland’s benchmark has been on hold at a record low since easing ended in March 2015.

"We expect flash CPI to arrive at 2.4% y/y in March vs. consensus at 2.3% y/y. March’s flash CPI is due Friday and we expect a further increase in the inflation rate toward 2.4% y/y – marginally above the market consensus of 2.3% y/y. The data should not affect the MPC stance in any way, as later in the year inflationary pressure should ease," said Erste Group Research in a report.

The zloty continued to appreciate over last week and EUR/PLN dropped to 4.2432 on Monday, the lowest level since April 2016. Technical studies are heavily bearish. The pair is currently holding support by weekly 200-SMA at 4.2468. Close below 4.2468 on the week raises scope for test of 4.0 levels. FxWirePro's Hourly EUR Spot Index was neutral at 45.814 at 1025 GMT. For more details on FxWirePro's Currency Strength Index, visit http://www.fxwirepro.com/currencyindex.

Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election

Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election  Vietnam’s Trade Surplus With US Jumps as Exports Surge and China Imports Hit Record

Vietnam’s Trade Surplus With US Jumps as Exports Surge and China Imports Hit Record  Asian Markets Surge as Japan Election, Fed Rate Cut Bets, and Tech Rally Lift Global Sentiment

Asian Markets Surge as Japan Election, Fed Rate Cut Bets, and Tech Rally Lift Global Sentiment  Oil Prices Slip as U.S.-Iran Talks Ease Middle East Tensions

Oil Prices Slip as U.S.-Iran Talks Ease Middle East Tensions  India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out

India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns

Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns  U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains

U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains