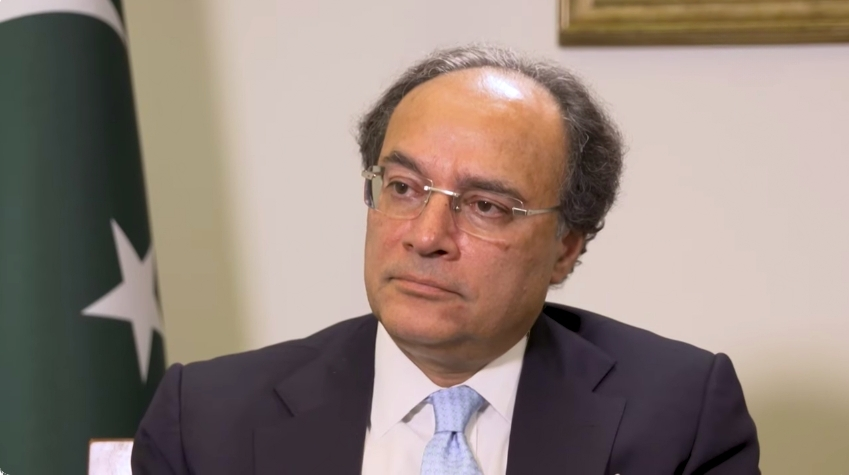

Pakistan has requested China to expand its currency swap line by 10 billion yuan ($1.4 billion), Finance Minister Muhammad Aurangzeb revealed during the IMF and World Bank Spring Meetings in Washington. The country already holds a 30 billion yuan swap line with China and aims to increase it to 40 billion yuan to strengthen financial stability. China’s central bank has been promoting currency swaps with several emerging markets, including Argentina and Sri Lanka.

Aurangzeb also confirmed progress towards issuing Pakistan’s first Panda bond, a debt instrument denominated in Chinese yuan for China’s domestic market. Discussions with the Asian Infrastructure Investment Bank (AIIB) and Asian Development Bank (ADB) for credit enhancements have been positive. The government hopes to launch the bond by the end of 2025 to diversify its funding sources.

In parallel, Pakistan expects the IMF Executive Board to approve a $1.3 billion climate resilience loan and the first review of its ongoing $7 billion bailout program by early May. Approval would release a $1 billion tranche crucial for maintaining economic stability.

Tensions with India have worsened following the killing of 26 people at a tourist site, with both countries imposing retaliatory measures. Trade between India and Pakistan, already minimal, stood at just $1.2 billion last year.

Despite regional instability, Aurangzeb forecasts Pakistan’s economic growth at around 3% for the financial year ending June 2025, aiming for 4–5% growth next year and a long-term target of 6%.

Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility

Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility  Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm

Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm  Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility

Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility  Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility

Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility  India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out

India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out  Gold and Silver Prices Climb in Asian Trade as Markets Eye Key U.S. Economic Data

Gold and Silver Prices Climb in Asian Trade as Markets Eye Key U.S. Economic Data  U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains

U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains  Asian Markets Surge as Japan Election, Fed Rate Cut Bets, and Tech Rally Lift Global Sentiment

Asian Markets Surge as Japan Election, Fed Rate Cut Bets, and Tech Rally Lift Global Sentiment  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal  Singapore Budget 2026 Set for Fiscal Prudence as Growth Remains Resilient

Singapore Budget 2026 Set for Fiscal Prudence as Growth Remains Resilient  Oil Prices Slip as U.S.-Iran Talks Ease Middle East Tensions

Oil Prices Slip as U.S.-Iran Talks Ease Middle East Tensions  U.S. Stock Futures Slide as Tech Rout Deepens on Amazon Capex Shock

U.S. Stock Futures Slide as Tech Rout Deepens on Amazon Capex Shock  Australian Household Spending Dips in December as RBA Tightens Policy

Australian Household Spending Dips in December as RBA Tightens Policy  Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality

Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality  UK Starting Salaries See Strongest Growth in 18 Months as Hiring Sentiment Improves

UK Starting Salaries See Strongest Growth in 18 Months as Hiring Sentiment Improves