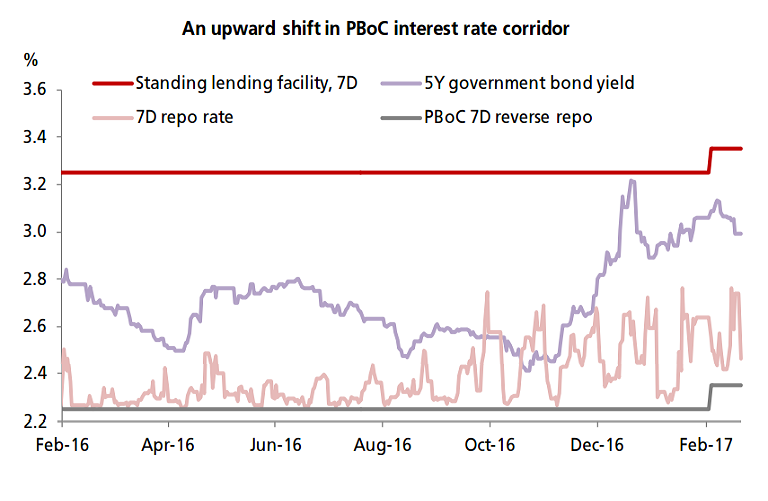

The People’s Bank of China's (PBoC) easing cycle since late 2014 has been accompanied by a buildup in borrowing. By end-2016, the nation’s debt to GDP ratio swelled to 270 percent from 150 percent in 2008. On 24 Jan, the PBoC lifted the one-year rates on Medium-term Lending Facility (MLF) to 3.1 percent from 3 percent for the first time since 2014. The upward trajectory of interest rate corridor suggests shift in the policymaker’s focus from stimulating growth to addressing financial risk.

China has modestly tightened policy in recent months by raising key money rates, though overall credit growth remains strong, hitting an all-time high in January. The latest tightening has impacted the bond market with yields on 10-year treasury rising to 3.497 percent on 6 Feb, the highest since Aug 2015. Beijing is now crafting a dual-speed monetary policy – raising market money rates while keeping benchmark rates at record lows. A major challenge for Beijing is how to contain leverage without turning the ongoing bond selloff into a broader market rout.

The PBoC is expected to proceed cautiously in raising interbank rates. The linkage between money markets and real economy has increased. Bonds are an increasingly important source of corporate financing. Rise in benchmark lending rates would hurt existing borrowers, as interest payments are typically tied to changes to benchmark rates. The PBoC would also like to keep its monetary policy flexible to help counter any possible trade clash with the US.

Data by China’s State Administration of Foreign Exchange (SAFE) suggests that the net USD purchase in FX spot market by Chinese residents and corporates was USD15.6bn in Jan 2017, down significantly from USD43.1bn in Dec 2016. However, in the forward market, the unsettled FX forward positions (USD purchase) continued to increase highlighting the weakening pressure on CNY.

The onshore Chinese yuan lost ground against the US dollar on Monday, after the People’s Bank of China cut the daily fix by the most in six weeks in an effort to curb speculation. Yuan in the spot market traded at 6.8772 per US dollar as of 1145 GMT, weaker by 0.19 percent or 107 basis points from 6.8665 late Friday.

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal  Jerome Powell Attends Supreme Court Hearing on Trump Effort to Fire Fed Governor, Calling It Historic

Jerome Powell Attends Supreme Court Hearing on Trump Effort to Fire Fed Governor, Calling It Historic  RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says

RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says  FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Bank of England Expected to Hold Interest Rates at 3.75% as Inflation Remains Elevated

Bank of England Expected to Hold Interest Rates at 3.75% as Inflation Remains Elevated  China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices  MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks

MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks