China is moving with a rapid pace to internationalize its currency Yuan and make it more accessible and acceptable to world community.

Yesterday, in its official website People's Bank of China (PBoC) announced its improved engagement with European Central Bank (ECB). Bank in 2013, PBoC signed bilateral swap agreement with ECB and this year it has tested the channel twice, once in April and once this month.

Over the past few years, PBoC has engaged itself in similar swap agreement, which is aimed at providing liquidity of Yuan around globe to smoothen trade transaction.

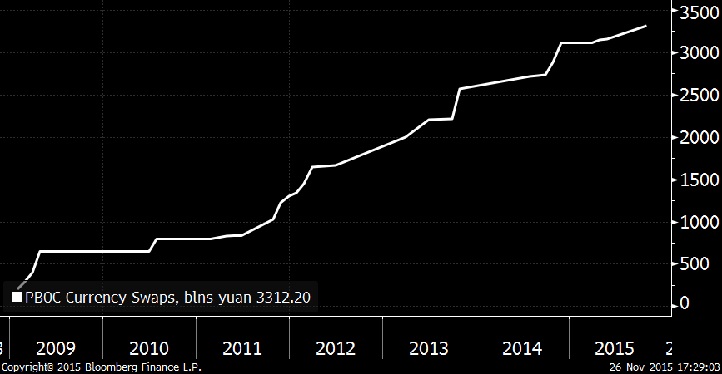

Tom Orlik, Bloomberg's chief Asia economist shared a chart in Twitter (attached) that show since 2010, PBoC's swap agreement has risen 7 fold from just around Yuan 500 billion to Yuan 3.3 trillion.

International monetary fund, is expected to include Yuan in its Special Drawing Right (SDR) basket this year. Staff has already recommended inclusion in their review. Final decision will be taken by board in its meeting, scheduled for November 30th.

While Chinese authorities, regulators and PBoC have already pursued lot many key reforms such as opening up its FX and debt market to world, more is to come as China to move fast with internationalization.

Bank of England Expected to Hold Interest Rates at 3.75% as Inflation Remains Elevated

Bank of England Expected to Hold Interest Rates at 3.75% as Inflation Remains Elevated  Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX  Bank of Japan Signals Cautious Path Toward Further Rate Hikes Amid Yen Weakness

Bank of Japan Signals Cautious Path Toward Further Rate Hikes Amid Yen Weakness  Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons

Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons  Jerome Powell Attends Supreme Court Hearing on Trump Effort to Fire Fed Governor, Calling It Historic

Jerome Powell Attends Supreme Court Hearing on Trump Effort to Fire Fed Governor, Calling It Historic