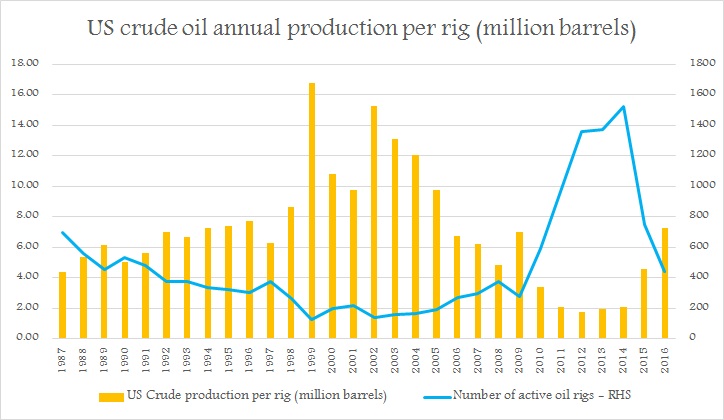

According to latest numbers from Baker Hughes, number of active oil rigs operating in United States has dropped to lowest levels since 2008/09 financial crisis. While back in October, 2014, the number of active rigs were at 1609 but as of last week it declined further by 15 rigs to 372, lowest since November, 2009.

In recent times, some market participants have taken note of the rig count to increase bullish bets on oil price recovery, suggesting drop in number of rigs indicating further declining in investments. However, our analysis suggests, when it comes to oil price recovery by changing fundamentals, other than intraday or few days boost, rigs count doesn’t matter much.

United States oil production is increasing becoming more efficient.

- Back in 2012, when about 1360 rigs were active on average, each rigs were producing about 1.74 million barrels per year. Efficiency improved through 2014 but not much to 2.08 million barrels/annum.

- However, combining data from Baker Hughes and U.S. Energy Information Administration (EIA) shows, efficiency improved 350% since 2014 heading into 2016 and we expect it is likely to improve further, because historically speaking as producers focus on lesser number of rigs, both their cost and production from each well improves.

- Back in 1999, only about 128 rigs, on an average were active throughout the year but each were producing about 16.77 million barrels of oil per annum. So still lots of scopes for improvements.

Shale technology, for good or bad have changed how oil markets operate, especially with their swing capability.

With such outlook, we don’t expect oil to recover much ground beyond $60/barrel in the medium term.

WTI is currently trading at $39.7/barrel, at 90 cents discount to Brent.

Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed