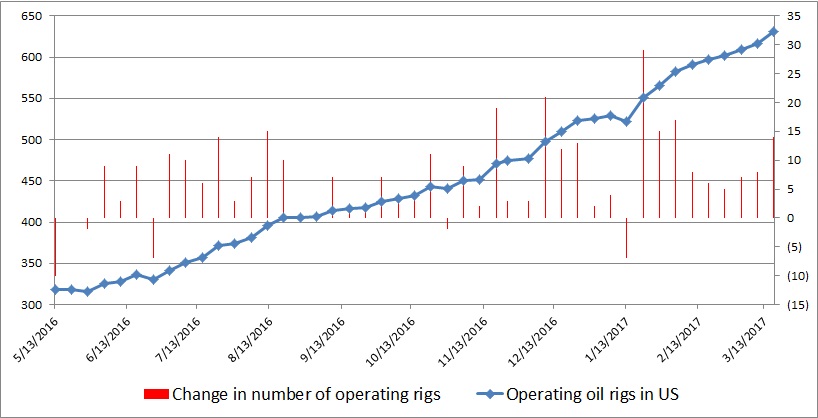

After the inventory report released last week unexpectedly signaled a draw down, the oil price moved higher only to suffer a setback from the Baker Hughes report released at the end of last week, which showed that the number of active oil rigs increased for a ninth consecutive week. After declining to just 316 in May last year, the numbers of operating rigs have doubled since then. As of last week’s report, the numbers of rigs operating in the United States have reached 631, the highest since September 2015. However, it is still down more than 60 percent from its peak in 2014. The oil production has reached 9.11 million barrels per day as of last week’s report, the highest level since early 2016. As the shale companies became better equipped to compete at a much lower price via cost cuttings, the production of oil in the United States have increased by 681,000 barrels per day since last summer.

Nevertheless, the backwardation in the oil market, which is currently at 51 cents per barrel, is suggesting the effectiveness of the OPEC deal in reducing supplies from the market. WTI is currently trading at $48 per barrel and we don’t expect the price to dip below $42 per barrel as the demand remains resilient.

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed