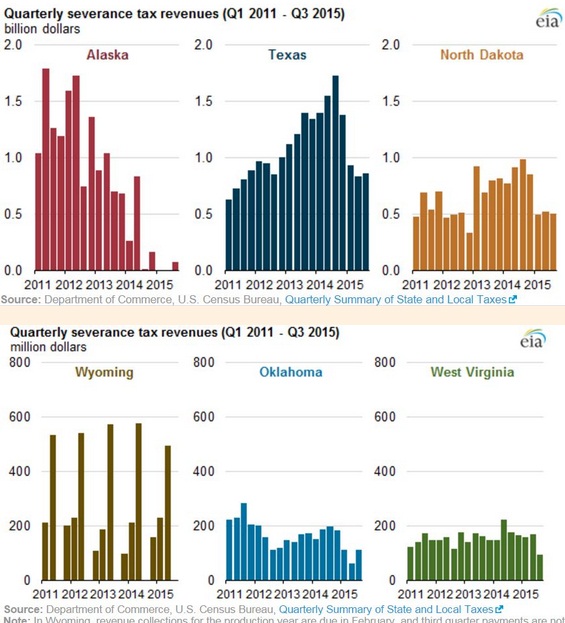

Drop in oil price is taking big bites in US tax revenue, mainly in oil producing states, according to latest report from Energy Information Administration (EIA).

While drop in oil tax isn't big for overall United States, for fossil fuel producing states it's quite a big deal. According 2014 figure, oil taxes contributed about 2% of overall US tax, its share in states of Alaska is as high as 72%, North Dakota 54%, Wyoming 39%, and Texas 11%.

Drop in oil prices, likely to lead these States either on the verge of bankruptcy or serious austerity. For Alaska, severance taxes have fallen from billions of Dollars per quarter to just few millions in 2015. Texas has much more diverse source of tax revenue but revenue from oil dropped around 50%, undoubtedly adding pressure. For North Dakota, severance tax revenue dropped from some $3.5 billion in 2014 to $2 billion in 2015.

Looking at oil price, it seems, 2016 would be no different or even could be worse.

These states are facing divergence under single monetary policy from FED, due to lower oil price.

WTI is currently trading at $31.3/barrel.