WTI dropped below $30/barrel momentarily yesterday as supply glut refuses to subside. It's however up today for the first time this year

Key factors at play in Crude market

- Middle East tensions between Iran and Saudi Arabia bearish for crude as it means supply war between two rivals.

- US lawmakers passed bill to lift 40 year oil ban on US crude export.

- Some of OPEC members requesting for emergency meeting but that may bear little fruit as OPEC remains dysfunctional without ceiling due to internal rivalry

- Due to new and improved technologies, crude oil production cost has declined for shale producers but such low price even pain for them.

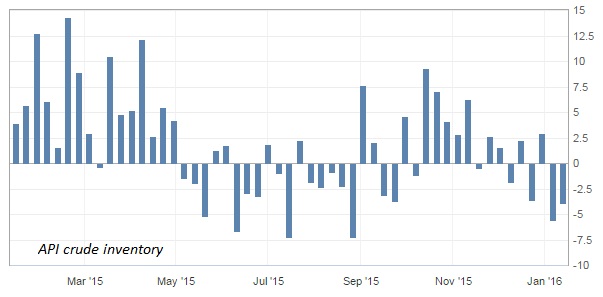

- American Petroleum Institute's (API) weekly report showed inventory dropped by -3.9 million barrels, second consecutive weekly decline. In last two weeks inventory dropped by -9.5 million barrels.

- Oil price is down, however lack of investments in the sector make prices vulnerable to supply shocks in future.

Today's inventory report from US Energy Information Administration (EIA), to be released at 15:30 GMT.

Trade idea

- We at FxWirePro remains committed to downside, price action suggests further drop in prices. Goldman Sachs has called for $20/barrel oil, while Standard Charted called for $10/barrel and EIA, $5/barrel.

- According to our calculations, next targets for oil are $28.8, $22 and $20.3/barrel for WTI. WTI is currently trading at $31.2/barrel.

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed