OPEC maintains its policy to shake out higher-cost producers

Saturday, June 6, 2015 10:26 AM UTC

- At yesterday's OPEC meeting, the major Gulf Co-Operation Council members (Saudi Arabia, the UAE and Kuwait) showed no sign of changing their strategy - adopted last November - of allowing market forces to set oil prices, rather than cutting output to shore up prices.

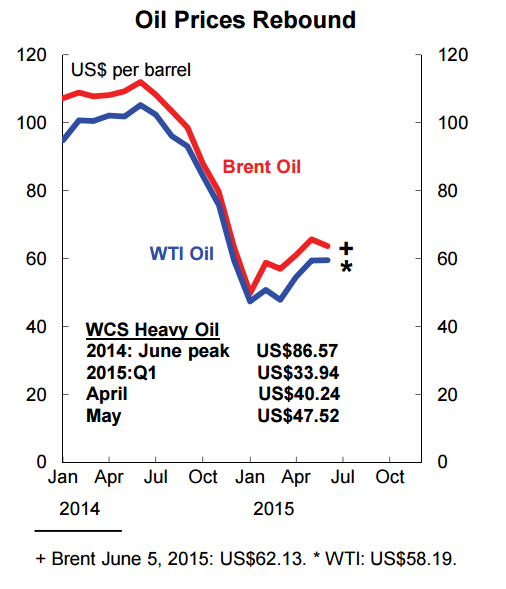

- However, market observers were somewhat reassured by the rollover of the existing OPEC sales quota at 30 mb/d for the second half of 2015, despite production as high as 31.2 mb/d in May (the highest in the past three years). Oil prices initially traded up by US$1 per barrel and remained at higher levels in mid-afternoon at US$58.19 for WTI and US$62.13 for Brent.

- OPEC is visibly pleased with the pick-up in global demand triggered by lower prices. Saudi Arabia has long held the view that oil prices should be kept at levels underpinning world demand growth, going back to the days of Sheik Yamani. The strategy has also been successful in triggering a sharp drop in global capex on exploration & production, which will eventually slow world production.

- While Iran's oil minister would like assurances that the group will make room for an additional 1 mb/d of Iranian oil exports, this matter was deferred, likely until Iran is in a position to actually boost volumes (after a nuclear deal is finalized and the terms of sanctions relief are known).

- OPEC will meet again on December 4.

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed