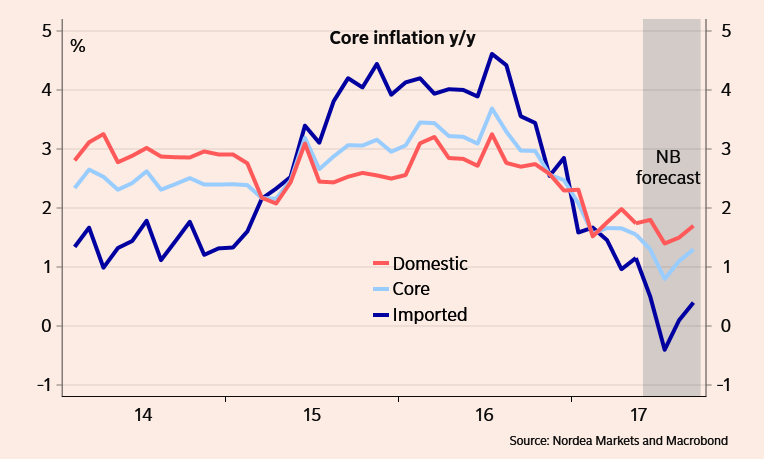

Statistic Norway is set to publish inflation data for the month of June on 10 July. Norway’s inflation rate fell further below the central bank's target level in May, despite the end of Easter sales and the first monthly increase in fuel prices for four months. The downward trend is expected to continue in June.

Norway Inflation Forecasts:

Nordea Bank forecast: CPI-ATE: 1.4%, CPI: 1.6%

DNB Bank: CPI-ATE: 1.3%, CPI: 1.7%

Norges Bank: CPI-ATE: 1.3%

Consensus: CPI-ATE: 1.4%, CPI: 1.7%

The Norwegian central bank last month kept its key policy interest rate unchanged at a record low 0.5 percent, but removed an easing bias that had said rates were more likely to fall than they were to rise in the short term. Norway’s central bank has maintained one of the highest key interest rates among European central banks, but has indicated it is unlikely to cut rates to try to stimulate inflation back toward the target.

Norway's mainland economy grew by just 0.9 percent in 2016, at a seven-year low. Capacity utilisation in the Norwegian economy appears to be higher than envisaged and increased activity and receding unemployment suggest that inflation will pick up. The central bank last month raised its mainland growth forecast for the current year to 2.0 percent from 1.6 percent seen in March. The International Monetary Fund (IMF) also reiterated projections, first made in May, that mainland GDP will grow by 1.75 percent in the current year and by 2.25 percent in 2018.

Norwegian central bank interest rates should remain at low levels despite signs the economy is recovering from a slump in oil prices, the country's key export, the International Monetary Fund (IMF) said on Wednesday. It added that further easing could be considered in the event of significant downside surprise on growth and inflation.

"Monetary policy should stay accommodative. Given the slack in the economy and weakened inflation outlook, maintaining an accommodative monetary policy stance is appropriate pending a durable recovery," IMF said in its annual review of Norway.

EUR/NOK is in a gradual uptrend since February when it hit lows of 8.7873 (last seen in July 2015). The pair was currently trading at 9.5645, up 0.19 percent on the day. Technical indicators are biased higher and we see scope for test of 9.88 levels. Strong support seen at 20-DMA at 9.50. Short-term weakness likely on break below.

FxWirePro's Hourly EUR Spot Index was at 103.757 (Bullish) at 1145 GMT. For more details on FxWirePro's Currency Strength Index, visit http://www.fxwirepro.com/currencyindex.

FxWirePro launches Absolute Return Managed Program. For more details, visit http://www.fxwirepro.com/invest

Asian Markets Surge as Japan Election, Fed Rate Cut Bets, and Tech Rally Lift Global Sentiment

Asian Markets Surge as Japan Election, Fed Rate Cut Bets, and Tech Rally Lift Global Sentiment  Jerome Powell Attends Supreme Court Hearing on Trump Effort to Fire Fed Governor, Calling It Historic

Jerome Powell Attends Supreme Court Hearing on Trump Effort to Fire Fed Governor, Calling It Historic  Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality

Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality  Bank of Japan Signals Cautious Path Toward Further Rate Hikes Amid Yen Weakness

Bank of Japan Signals Cautious Path Toward Further Rate Hikes Amid Yen Weakness  Oil Prices Slip as U.S.-Iran Talks Ease Middle East Tensions

Oil Prices Slip as U.S.-Iran Talks Ease Middle East Tensions  RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist

RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist