The Norges Bank is expected to increase policy rates by 25bp at the next meeting on March 21, in line with previous clear guidance, according to the latest research report from DNB Markets.

Along with the executive board’s interest rate decision, the Monetary Policy Report 1/19 will also be released and a press conference following the announcement will be held at 10:30 am CET.

The Executive Board decided to keep the policy rate unchanged at 0.75 percent at its meeting held in December last year. The decision was unanimous and in line with consensus expectations but the Bank guided for another rate hike in March 2019.

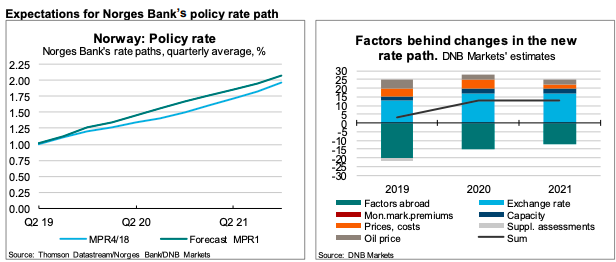

Data released since the December meeting broadly supported the central bank’s view on the economic trends. Furthermore, a weaker NOK, higher oil prices, and inflation above forecasts are all contributing factors that convince Norges Bank will raise rates faster than indicated in the December rat path.

A decline in the interest rate expectations abroad and an impaired outlook for the eurozone are likely to slow the rise in the rate path. The current path implies two 25bp rate hikes in 2019 with the latter at the December meeting, the report added.

Meanwhile, 3-month forward interest rates abroad have declined. From the week before Norges Bank’s December meeting, foreign FRAs have fallen by 7bp for 2019, 18bp for 2020, 27bp for 2021 and by 33bp for 2022.

"We believe the new rate path will imply the second rate hike to take place in September this year. Parallel to the meeting one year ago, we thus expect Norges Bank to state that "The Executive Board’s current assessment of the outlook and balance of risks suggests that the key policy rate will most likely be raised after summer 2019".", the report further commented.

RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist

RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist  China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices  Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady

Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady  BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook

BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook  Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election

Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election  U.S. Stock Futures Rise as Markets Brace for Jobs and Inflation Data

U.S. Stock Futures Rise as Markets Brace for Jobs and Inflation Data  Jerome Powell Attends Supreme Court Hearing on Trump Effort to Fire Fed Governor, Calling It Historic

Jerome Powell Attends Supreme Court Hearing on Trump Effort to Fire Fed Governor, Calling It Historic  Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal

Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal  Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality

Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality  Bank of Japan Signals Cautious Path Toward Further Rate Hikes Amid Yen Weakness

Bank of Japan Signals Cautious Path Toward Further Rate Hikes Amid Yen Weakness