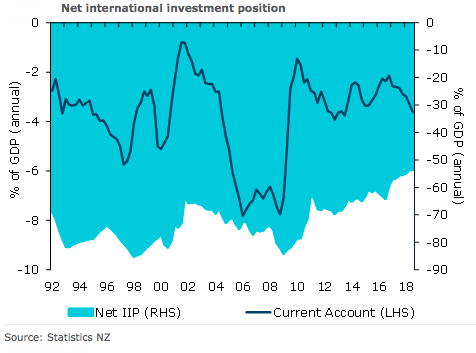

New Zealand’s Q3 balance of payments data was much as expected. Seasonal factors drove a quarterly deficit, but seasonally adjusted a narrowing goods and income deficit was offset by a smaller services surplus. The annual current account balance widened a touch from 3.3 percent to 3.6 percent of GDP.

The unadjusted quarterly current account balance pushed deeper into deficit in Q3 (from $1.6bn in Q2 to $6.1bn), as it always does in Q3. The goods balance slipped into deficit as exports fell (mirroring seasonal agricultural production) and imports began their seasonal lift (which generally peaks in Q4).

The unadjusted services balance dipped into deficit territory (-$0.3bn), with imports up $0.5bn (reflecting the usual pickup in kiwis going on overseas holidays to escape winter) and exports down $0.7bn (reflecting the seasonal lull in inbound tourists). A narrowing quarterly income deficit (from $2.7bn to $2.6bn) provided some offset.

The annual deficit widened to $10.5bn from $9.5bn in Q2, which saw the current account as a share of GDP tick up 0.3 percentage point to 3.6 percent. This brings the annual deficit in line with its historical average of 3.6 percent of GDP.

In seasonally adjusted terms, the quarterly current account deficit narrowed by $0.1bn to $2.6bn. As expected, this was driven by a narrowing goods deficit (by $0.3bn to -$1.0bn), with a narrowing income deficit also lending a hand. A narrowing seasonally adjusted services surplus (by $0.3bn to $1.1bn) provided an offset.

"Overall, ongoing broad-based strength across other primary sector exports is expected to drive a slight narrowing in the annual goods deficit over the year ahead, but solid imports growth (on the back of continued population-led growth in domestic demand), will keep the balance in check. Likewise, the services surplus is expected to remain buoyed by solid tourist spending, but with services imports growth broadly keeping pace and the balance contained. Rising primary income outflows are expected to drive a gradual widening in the income deficit as rising global interest rates see international debt servicing costs lift," ANZ Research commented in its latest report.

Lee Seung-heon Signals Caution on Rate Hikes, Supports Higher Property Taxes to Cool Korea’s Housing Market

Lee Seung-heon Signals Caution on Rate Hikes, Supports Higher Property Taxes to Cool Korea’s Housing Market  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Vietnam’s Trade Surplus With US Jumps as Exports Surge and China Imports Hit Record

Vietnam’s Trade Surplus With US Jumps as Exports Surge and China Imports Hit Record  Asian Markets Surge as Japan Election, Fed Rate Cut Bets, and Tech Rally Lift Global Sentiment

Asian Markets Surge as Japan Election, Fed Rate Cut Bets, and Tech Rally Lift Global Sentiment  U.S. Stock Futures Rise as Markets Brace for Jobs and Inflation Data

U.S. Stock Futures Rise as Markets Brace for Jobs and Inflation Data  Gold and Silver Prices Climb in Asian Trade as Markets Eye Key U.S. Economic Data

Gold and Silver Prices Climb in Asian Trade as Markets Eye Key U.S. Economic Data  Asian Currencies Stay Rangebound as Yen Firms on Intervention Talk

Asian Currencies Stay Rangebound as Yen Firms on Intervention Talk