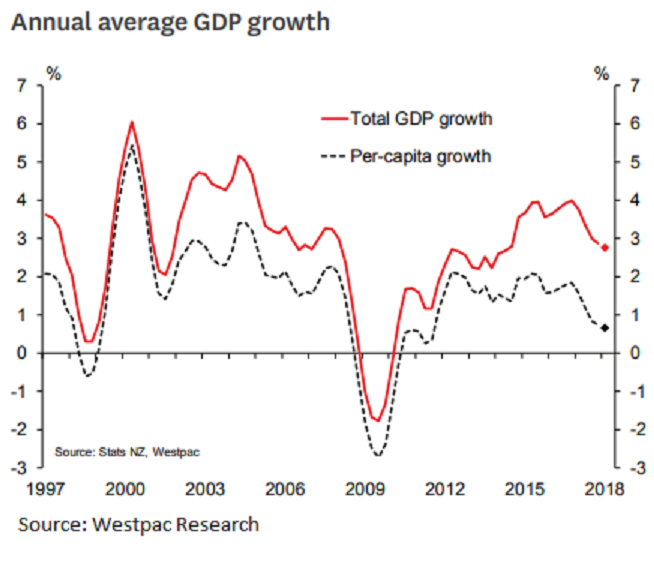

New Zealand’s gross domestic product (GDP) for the first quarter of this year is expected to rise 0.4 percent, marking a third consecutive quarter of subdued growth in activity, according to the latest report from Westpac Research.

A lift in government spending will help to support growth, but this is more of a prospect for next year’s growth rate. In contrast, the Reserve Bank and the Treasury have been anticipating a re-acceleration in growth this year, with both of them expecting a 0.7 percent rise in March quarter GDP in their most recent forecasts.

A softer outturn would put some pressure on the Government’s revenue and spending projections and would reinforce the message that Official Cash Rate hikes are quite a way off. Westpac’s GDP forecast appears to be in a similar range to other market forecasters. An outcome in line with the view is not likely to have a significant impact on market interest rates or the exchange rate.

"The current account deficit is expected to widen slightly, due to some softness in exports that may prove to be temporary. This decline is likely to be short-lived: commodity prices have since improved, and we suspect that the drop in volumes was due to the timing of shipments", the report commented.

Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm

Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm  Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal

Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal  China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices  Nikkei 225 Hits Record High Above 56,000 After Japan Election Boosts Market Confidence

Nikkei 225 Hits Record High Above 56,000 After Japan Election Boosts Market Confidence  Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election

Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election  U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains

U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains