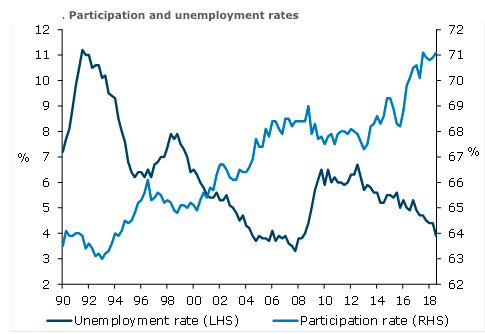

New Zealand’s unemployment rate is expected to see a small bounce from 3.9 percent to 4.1 percent in the fourth quarter of 2018, after last quarter’s very large, unexpected drop of 0.5 percentage point, according to the latest report from ANZ Research.

Further, wage inflation is expected to have firmed to 2.1 percent y/y, reflecting previous tightening in the labour market, the higher minimum wage, and a boost from last year’s nurses’ pay settlement. But underlying wage inflation is seen to continue to improve only gradually.

Looking through the noise, the labour market is expected to have been broadly stable in the December quarter, consistent with continued – but moderating – GDP growth and cautious hiring intentions in business surveys.

Employment growth is expected to soften from 2.8 percent to 2.6 percent y/y. In the quarter, employment is expected to have grown a soft 0.3 percent, with an element of pay-back from last quarter’s strong 1.1 percent q/q print. Labour force participation is expected to have remained elevated at 71 percent of the working-age population.

Nominal LCI private sector wages are expected to have risen 0.6 percent q/q, with the nurses’ pay settlement expected to provide a boost. Annual wage inflation is expected to have firmed from 1.9 percent to 2.1 percent y/y, with Q2’s increase in the minimum wage continuing to contribute; we estimate +0.2 percentage point from this.

"In light of this, we expect the labour market to tighten only very modestly over the medium term, as the net migration cycle eases. We expect to see continued, but not spectacular, employment growth – consistent with our view that it will be difficult for the economy to grow above trend," the report added.

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom  Asian Currencies Stay Rangebound as Yen Firms on Intervention Talk

Asian Currencies Stay Rangebound as Yen Firms on Intervention Talk  Gold and Silver Prices Climb in Asian Trade as Markets Eye Key U.S. Economic Data

Gold and Silver Prices Climb in Asian Trade as Markets Eye Key U.S. Economic Data  Vietnam’s Trade Surplus With US Jumps as Exports Surge and China Imports Hit Record

Vietnam’s Trade Surplus With US Jumps as Exports Surge and China Imports Hit Record  India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out

India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out  Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal

Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal  Australian Pension Funds Boost Currency Hedging as Aussie Dollar Strengthens

Australian Pension Funds Boost Currency Hedging as Aussie Dollar Strengthens  Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm

Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm  Russian Stocks End Mixed as MOEX Index Closes Flat Amid Commodity Strength

Russian Stocks End Mixed as MOEX Index Closes Flat Amid Commodity Strength  U.S. Stock Futures Rise as Markets Brace for Jobs and Inflation Data

U.S. Stock Futures Rise as Markets Brace for Jobs and Inflation Data