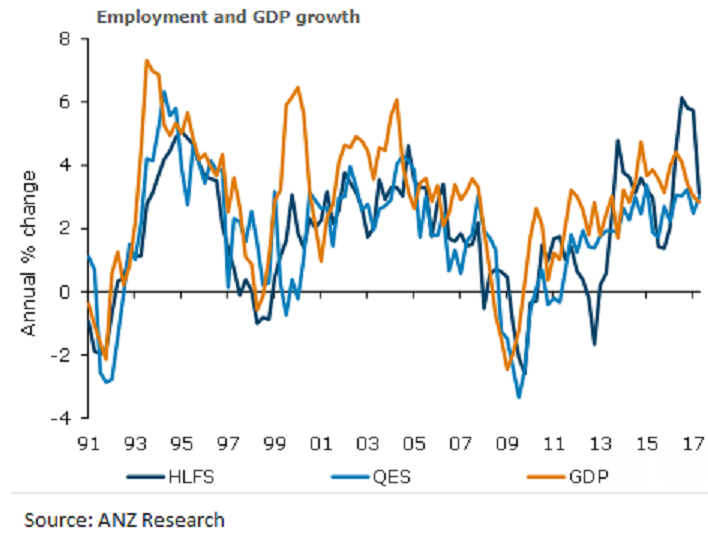

New Zealand’s labor market remained upbeat during the fourth quarter of this year but is perhaps showing a few more signs of slowing under its own (capacity-constrained) weight. Despite this, signs of a sustained lift in wage pressure remain tentative at best. Some wage measures are off their lows but are hardly lifting in a way that would suggest broader inflation pressures are about to be unleashed.

HLFS employment rose 0.5 percent q/q, which, when considered in the context of the 2.2 percent q/q surge in Q3, is a decent result. The participation rate dipped only 0.1 percentage points to 71.0 percent, only a whisker below all-time highs. The unemployment rate fell 0.1 percentage points to 4.5 percent, which is a nine-year low.

Despite the fall in the unemployment rate, both the underemployment and underutilization rates rose in the quarter; the latter from 12 percent to 12.1 percent, which is still historically high and down only approx. 3 percentage points from its 2012 peak. It suggests there is still a pool of labor resources available, although perhaps this speaks more to what we suspect is a mismatch between the skills firms are currently demanding and what is available.

Further, the public sector LCI rose 0.5 percent q/q (1.5 percent y/y). The unadjusted private and all-sector measures rose 0.8 percent and 0.9 percent q/q respectively, keeping annual growth in these measures relatively stable. Private sector average hourly earnings did rise 0.8 percent q/q, which lifted annual growth to 3.1 percent y/y, but this measure is volatile and can be thrown around by compositional issues.

"We, therefore, see little in the figures to alter the RBNZ’s cautious stance towards the monetary policy outlook," ANZ Research commented in its latest research report.

Lastly, FxWirePro has launched Absolute Return Managed Program. For more details, visit http://www.fxwirepro.com/invest

U.S. Stock Futures Rise as Markets Brace for Jobs and Inflation Data

U.S. Stock Futures Rise as Markets Brace for Jobs and Inflation Data  Gold and Silver Prices Climb in Asian Trade as Markets Eye Key U.S. Economic Data

Gold and Silver Prices Climb in Asian Trade as Markets Eye Key U.S. Economic Data  South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom  Australian Pension Funds Boost Currency Hedging as Aussie Dollar Strengthens

Australian Pension Funds Boost Currency Hedging as Aussie Dollar Strengthens  Russian Stocks End Mixed as MOEX Index Closes Flat Amid Commodity Strength

Russian Stocks End Mixed as MOEX Index Closes Flat Amid Commodity Strength  Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality

Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality  Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target

Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target  Yen Slides as Japan Election Boosts Fiscal Stimulus Expectations

Yen Slides as Japan Election Boosts Fiscal Stimulus Expectations