New Zealand’s consumer confidence eased during the month of March, although still remaining above the average. The data continues to signal a good tempo for spending trends and economic momentum.

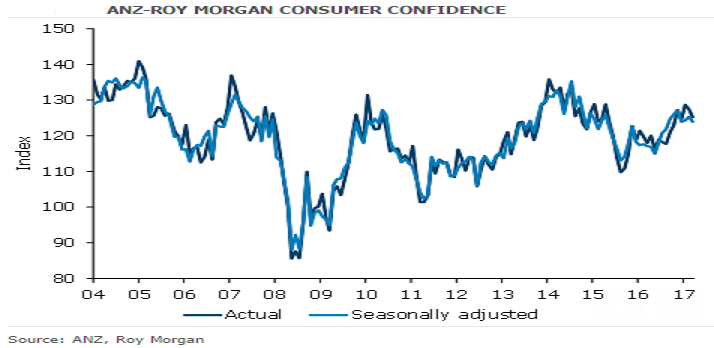

The ANZ-Roy Morgan Consumer Confidence Index eased from 127.4 to 125.2 in March (average 118). Once we adjust for the usual seasonal pattern, consumer confidence eased from 125.3 to 123.9. The Current and Future Conditions Indexes both eased 2 points from elevated readings. At 126.0 and 125.0 respectively, the levels for both indexes remain historically high.

Further, a net 13 percent feel better off financially compared with a year ago, around the average for the past six months. Consumer enthusiasm for buying major household items eased from +41 to +38 – this measure has been oscillating around the 40 mark for three years.

Net optimism towards the economy one year out eased from +26 to +21. However, respondents’ views towards their own financial situation in 12 months’ time lifted a touch to a net +32 percent. House price inflation expectations lifted slightly from 4.3 percent to 4.6 percent. Inflation expectations eased from 3.6 percent to 3.4 percent and continue to oscillate around 3-4 percent, with no trend apparent.

"Our confidence composite gauge (which combines business and consumer sentiment) continues to point to GDP growth accelerating north of 4 percent. We don’t think the economy can actually grow that fast, at least not for long, as the workers simply aren’t available, particularly in the construction sector but increasingly economy-wide, including services," ANZ Research commented in its latest research note.

Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal

Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal  Gold and Silver Prices Slide as Dollar Strength and Easing Tensions Weigh on Metals

Gold and Silver Prices Slide as Dollar Strength and Easing Tensions Weigh on Metals  Russian Stocks End Mixed as MOEX Index Closes Flat Amid Commodity Strength

Russian Stocks End Mixed as MOEX Index Closes Flat Amid Commodity Strength  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal  India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out

India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out