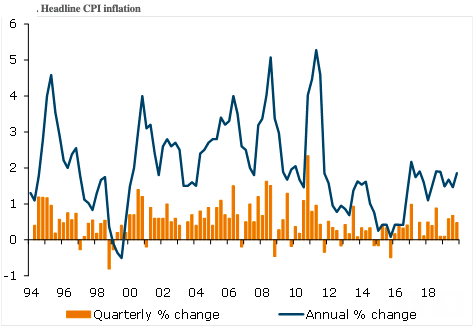

New Zealand’s consumer price inflation (CPI) lifted 0.5 percent q/q in Q4 – in line with ANZ forecasts, but stronger than the market (0.4 percent) and the Reserve Bank of New Zealand’s (RBNZ) November MPS forecast (0.2 percent).

At 1.9 percent, annual inflation is running just 0.1 percentage points shy of the 2 percent target midpoint, but with non-tradeable inflation expected to remain close to 3 percent y/y and a lift in tradeable inflation in the pipeline, 2020 should bring a 2-handle.

The surprise versus the RBNZ’s forecast comes from stronger-than-expected tradeable inflation. This is the more volatile and less persistent type of inflation, given it is heavily influenced by exchange rate movements and global supply and demand dynamics, ANZ Research reported.

Tradable inflation lifted 0.4 percent q/q (RBNZ: -0.2 percent q/q), reflecting recent NZD weakness. The lift is stronger than is typical for a December quarter. A smaller seasonal dip in fruit and vegetable prices contributed.

Non-tradable (domestic) inflation rose 0.6 percent q/q, with housing-related costs (rents and the purchase of housing) remaining a persistent driver. With the housing market picking up, this theme looks set to continue for a while yet.

Annual headline inflation lifted to 1.9 percent from 1.5 percent in Q3, with non-tradable inflation dipping 0.1 percentage point from Q3 to 3.1 percent y/y and tradable inflation lifting to 0.1 percent y/y from -0.7 percent y/y.

"Looking forward, we think economic activity is poised to gradually accelerate over the year ahead and grow around trend over the medium term, with resurgence in the housing market, improving business sentiment and the promise of a little extra government spending on key infrastructure all supporting. Unless something untoward happens, we think the RBNZ will keep the OCR at its current, stimulatory, level of 1 percent for the foreseeable future," ANZ Research further commented in the report.

India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out

India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out  South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom  Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns

Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns  Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality

Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality  U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains

U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains  China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices  Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX  Silver Prices Plunge in Asian Trade as Dollar Strength Triggers Fresh Precious Metals Sell-Off

Silver Prices Plunge in Asian Trade as Dollar Strength Triggers Fresh Precious Metals Sell-Off