New Zealand’s REINZ house sales is expected to have fallen by 7 percent during the month of February on a seasonally adjusted basis, according to the latest report from ANZ Research, after an eager start to the year (up 13 percent in January). Prices have nudged higher to start the year, but this is expected to be short lived.

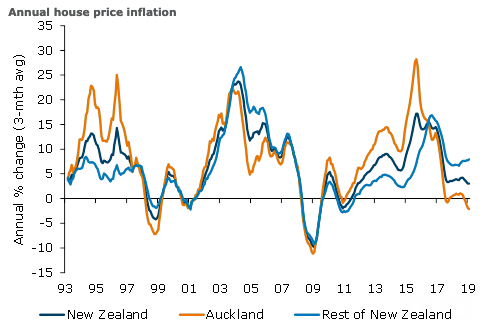

Slack in the Auckland market has increased, which is likely to see weakness there continue. Meanwhile, some provincial markets are seeing solid house price increases. Affordability constraints are being felt and investors are wary (with a possible capital gains tax no doubt contributing).

Credit availability does not appear to be a particular constraint, though proposed changes in bank capital requirements will likely weigh if implemented. Prices have been boosted by easing in LVR restrictions and falls in mortgage rates late last year, but this lift is expected to prove temporary. Annual house price inflation is stable at 3 percent, ANZ Research reported.

Days to sell lengthened nationwide from 39 to 40 days, reflecting increased slack in the Auckland market, where days to sell lengthened from 43 to 49 days. Days to sell at this level is the longest it has been in Auckland since the 2008/09 recession.

While slack at this level may not linger reflecting usual volatility in the data, it does suggest that weakness in prices may continue for a while yet – though price declines are expected to remain gradual, the report added.

Meanwhile, Auckland house prices rose 0.5 percent m/m in February, but they are down 0.5 percent over the past three months and more than 2 percent over the past year.

In the rest of New Zealand, prices were up 0.9 percent (8.2 percent y/y). Prices have seen a solid lift over the past three months, up 2.2 percent. All regional housing markets outside Auckland and Canterbury remain tight. Hawke’s Bay, Manawatu-Whanganui, West Coast and Southland have seen particularly large increases over the past three months.

Image Courtesy: ANZ Research

U.S. Stock Futures Rise as Markets Brace for Jobs and Inflation Data

U.S. Stock Futures Rise as Markets Brace for Jobs and Inflation Data  Gold and Silver Prices Climb in Asian Trade as Markets Eye Key U.S. Economic Data

Gold and Silver Prices Climb in Asian Trade as Markets Eye Key U.S. Economic Data  Indian Refiners Scale Back Russian Oil Imports as U.S.-India Trade Deal Advances

Indian Refiners Scale Back Russian Oil Imports as U.S.-India Trade Deal Advances  Vietnam’s Trade Surplus With US Jumps as Exports Surge and China Imports Hit Record

Vietnam’s Trade Surplus With US Jumps as Exports Surge and China Imports Hit Record  Oil Prices Slip as U.S.-Iran Talks Ease Middle East Tensions

Oil Prices Slip as U.S.-Iran Talks Ease Middle East Tensions  U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains

U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal  South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom  China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices  Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal

Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal