After expanding at a solid rate of +0.5 percent quarter-on-quarter in Q1, Mexican economy contracted -0.2 percent quarter-on-quarter in Q2. The close economic relations with the US that have developed under NAFTA have so far helped Mexico, which is largely a commodity-exporting country to alleviate the negative effects of the oil price slump. However, upcoming US presidential elections are stoking uncertainty about future economic relations between the two nations.

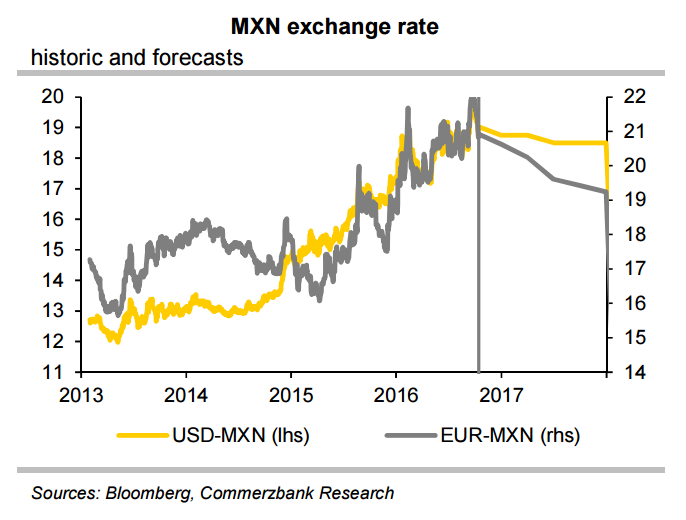

The peso suffered further major losses against the USD in September in wake of the election-induced uncertainty. Low oil price, sharp rise in interest rates and the government’s spending cuts are major drag on the outlook. Mexico's moderate economic outlook is likely to limit the peso's upside potential. U.S. interest rate hikes could add to further downside pressure.

Mexican central bank (Banxico) has pre-empted the Fed and hiked interest rates by 175bp to 4.75 percent between December 2015 and September this year. Banxico is apparently seeking to put a cap on the exchange rate versus the dollar so as to counteract inflation risks early on. The Banxico is expected to follow Fed rate hikes to prevent the peso from depreciating.

"Overall, we expect USD-MXN to level off at 18.50 next year. A surprisingly hawkish Fed would imply downside risks to our MXN forecast, though, and also to our rate forecast," said Commerzbank in a report.

The last US presidential debate concluded overnight with Clinton gaining a clean sweep across all three of this year's presidential debates. As chances of Hillary Clinton to win the election increase, the peso which has managed to recover some of its losses since late September will extend recovery rally.

Forex market largely ignored last US presidential debate. The Mexican Peso traded initially in a tepid manner, rallied to break the 18.50 key area on conclusion of the debate. MXN is extending weakness as we head into ECB rate decision due ahead. USD/MXN was trading at 18.60 at around 12:15 GMT.

Oil Prices Slide on US-Iran Talks, Dollar Strength and Profit-Taking Pressure

Oil Prices Slide on US-Iran Talks, Dollar Strength and Profit-Taking Pressure  Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm

Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm  Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility

Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility  Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election

Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election  Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility

Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility  South Korea’s Weak Won Struggles as Retail Investors Pour Money Into U.S. Stocks

South Korea’s Weak Won Struggles as Retail Investors Pour Money Into U.S. Stocks  India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out

India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out  Trump Endorses Japan’s Sanae Takaichi Ahead of Crucial Election Amid Market and China Tensions

Trump Endorses Japan’s Sanae Takaichi Ahead of Crucial Election Amid Market and China Tensions  Russian Stocks End Mixed as MOEX Index Closes Flat Amid Commodity Strength

Russian Stocks End Mixed as MOEX Index Closes Flat Amid Commodity Strength  Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility

Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility