The Bank Negara Malaysia (BNM) in its first monetary policy meeting of 2017 on 16th January held its benchmark overnight policy rate at 3.00 percent and said that the decision was supported by stronger household demand, higher inflation prospects and weak MYR. In the monetary policy statement that followed BNM noted that the private sector activity will be the key driver of economic growth and committed to continuously inject liquidity to ensure stable FX market.

Data released in February showed the pace of contraction in Malaysia’s manufacturing sector eased in January, indicating that the manufacturing sector had come through the worst of its downturn. Malaysia's headline Nikkei manufacturing PMI index rose to 48.6 in January from 47.1 in December. The pace of contraction in production also decelerated to the weakest since May 2015. Business confidence also rose to a four-month high at the beginning of 2017.

Meanwhile, employment in the sector stayed in the expansion territory for the fifth straight month. However, the pace of job creation slowed further and was just marginal. The weak ringgit aided in stimulating exports, but at the same time it continued to put upward pressures on cost burdens, with input prices rising at the most rapid rate in the series history. Prices charged rose at the sharpest pace since May 2016.

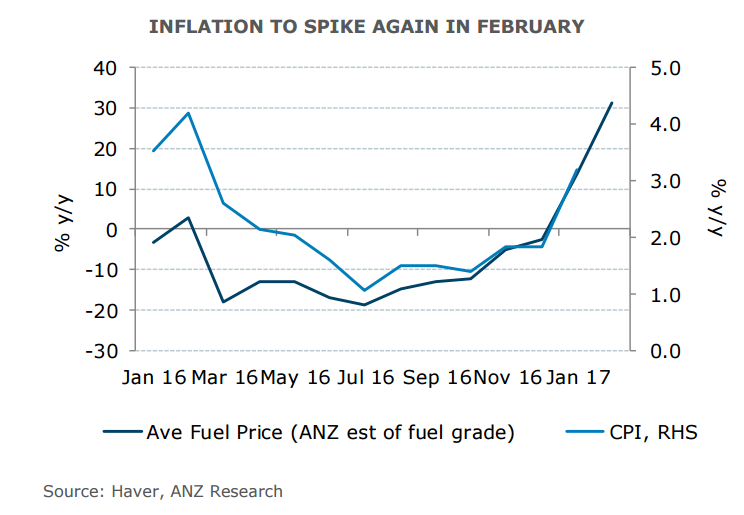

Malaysia’s headline CPI spiked in January owing to higher domestic fuel prices. Data released earlier on Wednesday showed Malaysia’s headline CPI spiked to 3.2 percent in January from 1.8 percent in December, much higher than consensus forecasts at 2.7 percent. Transport costs rose a significant 8.3 percent y/y in January while food price inflation (which has a 30.2 percent weight in the CPI basket) also increased 4.0 percent y/y during the month, partly due to removal of subsidies for essential items such as cooking oil. Going forward, Malaysia’s inflation is likely to continue to edge higher in February as oil prices continue their grind higher. Analysts at ANZ Research expect inflation in February to rise to 4 percent y/y.

Currency stability will be a key focus for the central bank in the near term. Downside risks to growth due to global uncertainties remain, but a recent upturn in some indicators including exports will allow the central bank to breathe more easily. Hence the inflation spike by itself is unlikely to elicit a policy response from BNM.

"We expect Bank Negara Malaysia (BNM) to maintain their benchmark overnight policy rate at 3.00% at their upcoming policy meeting on 2 March as economic activity has evolved in line with expectations," said ANZ Research in a report.

The Malaysian ringgit was extending range trade against the US Dollar at 4.4555 at 0930 GMT. FxWirePro's hourly USD strength index was slightly bullish at 53.1002. For more details on FxWirePro's Currency Strength Index, visit http://www.fxwirepro.com/currencyindex.

Jerome Powell Attends Supreme Court Hearing on Trump Effort to Fire Fed Governor, Calling It Historic

Jerome Powell Attends Supreme Court Hearing on Trump Effort to Fire Fed Governor, Calling It Historic  BOJ Holds Interest Rates Steady, Upgrades Growth and Inflation Outlook for Japan

BOJ Holds Interest Rates Steady, Upgrades Growth and Inflation Outlook for Japan  U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains

U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains  Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal

Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal  China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices  Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility

Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility  Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility

Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility  Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran

Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran  Gold and Silver Prices Rebound After Volatile Week Triggered by Fed Nomination

Gold and Silver Prices Rebound After Volatile Week Triggered by Fed Nomination  Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election

Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election  Australian Household Spending Dips in December as RBA Tightens Policy

Australian Household Spending Dips in December as RBA Tightens Policy  RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist

RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist