Whole focus of the market this year has been looming rate hike from FED. While policy officials have indicated that they are looking at various data points which would show further improvement in US labor market and make policymakers confident enough that inflation would eventually reach FED's 2% target in the medium term, analysts has focused on almost anything under the Sun, which might influence FED's decisions.

While actual inflation remains weak enough, thanks to weaker commodity prices, rising inflation expectations this year has grabbed a lot a lot of attention across globe, including ours. Many analysts and eminent economists believe that ultra-loose monetary policy pursued by central banks globally will finally result in massive turn around in inflation and rising inflation expectations are showing signs of such.

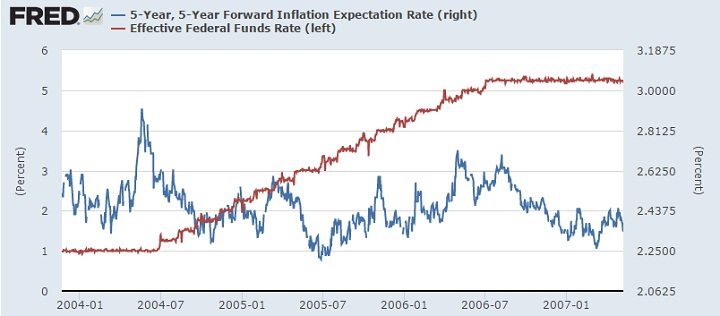

Lessons from last FED hike - inflation expectations and FED funds rate

The above argument brings us to the point, how influential is the expectations for FED funds rate?

- Even if rising expectations are pointing to higher inflation ahead, historically speaking link has not been strong enough.

- Last time FED started hiking rates, was back in 2004, more than a decade ago. Inflation expectations were hovering around 2.59% as measured by 5y-5y forward inflation expectations and Federal fund rate was at 1% around. By July, 2006 effective FED funds rate reached 5.25% with inflation expectations hovering around 2.59%. The chart above explains the movement.

Inflation expectation as measured by 5y-5y forward inflation expectation has reached around 2%, lowest since March, may not very influential when it comes to first rate hike from FED.

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary