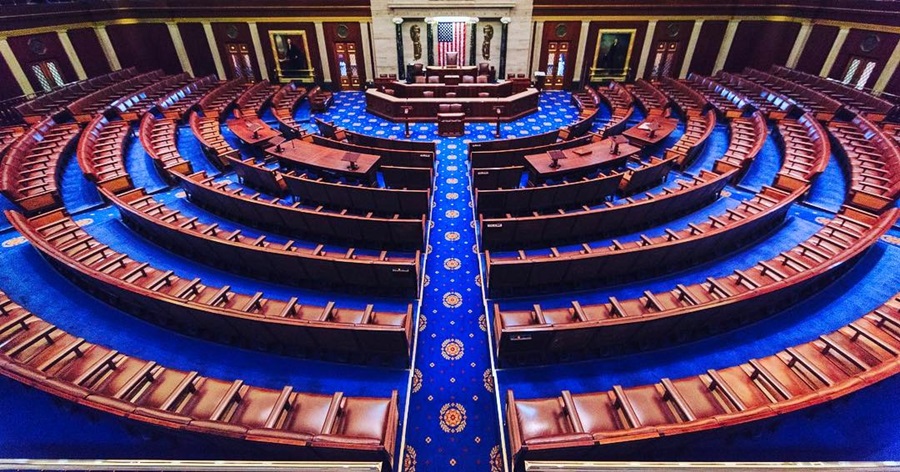

The creation of the regulation for cryptocurrency is now in full swing. The latest group to be covered by it is the U.S. House of Representatives, after the house’s Ethics Committee recently released a memorandum mandating its members to disclose any cryptocurrency holdings valuing above $1,000, Cointelegraph reported.

The memo that was issued highlights a wide scope of disclosure instructing lawmakers to reveal possession of crypto holdings, initial coin offering (ICO) involvement, and any profit derived from mining cryptocurrencies. The Ethics Committee has deemed virtual currencies a “form of currency” despite the fact that the U.S. Commodity Futures Trading Commission (CFTC) has categorized some cryptocurrencies as commodities, particularly Bitcoin.

The committee explained that their decision is “with respect to financial disclosure,” and members of the house are expected to abide by the memorandum. As such, house members and their spouses are to disclose cryptocurrencies amounting to over $1,000 filed under Assets and Unearned Income.

Meanwhile, the purchase, sale or exchange of virtual currency of more than $1,000 will be placed under “Transactions” in their yearly Financial Disclosure Statement. The memorandum further instructs that for the intent of disclosure, purchases, sales, and exchanges involving $1,000 in crypto dealings are to be filed under the Periodic Transaction Report, which is to be passed within 45 days of the transaction.

The committee said that these decisions are standing in parallel with CFTF’s stance, including that of the Securities and Exchange Commission (SEC), even though the SEC itself has deemed Bitcoin and Ethereum not securities. Moreover, the committee strongly advises house members to get in touch with them if they decide to participate in an ICO. The advice comes from the fact that the SEC is still deliberating on which stance it will take regarding this new fundraising endeavor.

As it stands, the House’s rules bar any of its members from earning more than $28,050 annually from any source unrelated to their congressional position. The committee made it clear that profit gained through crypto mining, as well as any payment made via crypto, is under the effect of this rule. Meanwhile, crypto trading will not be subject to such limitations as it’s deemed a “form of investment or unearned income.”

The committee’s decision comes on the same day as the U.S. Office of Government Ethics issued a disclosure instruction for federal workers. It mandates employees to disclose information on any crypto possession if their holdings are over $1,000. They’re also to announce any income gained through crypto if the said income exceeds $200 within the reporting period.

Nvidia CEO Jensen Huang Says AI Investment Boom Is Just Beginning as NVDA Shares Surge

Nvidia CEO Jensen Huang Says AI Investment Boom Is Just Beginning as NVDA Shares Surge  Tencent Shares Slide After WeChat Restricts YuanBao AI Promotional Links

Tencent Shares Slide After WeChat Restricts YuanBao AI Promotional Links  Palantir Stock Jumps After Strong Q4 Earnings Beat and Upbeat 2026 Revenue Forecast

Palantir Stock Jumps After Strong Q4 Earnings Beat and Upbeat 2026 Revenue Forecast  Global PC Makers Eye Chinese Memory Chip Suppliers Amid Ongoing Supply Crunch

Global PC Makers Eye Chinese Memory Chip Suppliers Amid Ongoing Supply Crunch  Anthropic Eyes $350 Billion Valuation as AI Funding and Share Sale Accelerate

Anthropic Eyes $350 Billion Valuation as AI Funding and Share Sale Accelerate  AMD Shares Slide Despite Earnings Beat as Cautious Revenue Outlook Weighs on Stock

AMD Shares Slide Despite Earnings Beat as Cautious Revenue Outlook Weighs on Stock  SoftBank and Intel Partner to Develop Next-Generation Memory Chips for AI Data Centers

SoftBank and Intel Partner to Develop Next-Generation Memory Chips for AI Data Centers  SpaceX Prioritizes Moon Mission Before Mars as Starship Development Accelerates

SpaceX Prioritizes Moon Mission Before Mars as Starship Development Accelerates  SpaceX Reports $8 Billion Profit as IPO Plans and Starlink Growth Fuel Valuation Buzz

SpaceX Reports $8 Billion Profit as IPO Plans and Starlink Growth Fuel Valuation Buzz  Sony Q3 Profit Jumps on Gaming and Image Sensors, Full-Year Outlook Raised

Sony Q3 Profit Jumps on Gaming and Image Sensors, Full-Year Outlook Raised  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  SoftBank Shares Slide After Arm Earnings Miss Fuels Tech Stock Sell-Off

SoftBank Shares Slide After Arm Earnings Miss Fuels Tech Stock Sell-Off  Nintendo Shares Slide After Earnings Miss Raises Switch 2 Margin Concerns

Nintendo Shares Slide After Earnings Miss Raises Switch 2 Margin Concerns  Elon Musk’s SpaceX Acquires xAI in Historic Deal Uniting Space and Artificial Intelligence

Elon Musk’s SpaceX Acquires xAI in Historic Deal Uniting Space and Artificial Intelligence  Instagram Outage Disrupts Thousands of U.S. Users

Instagram Outage Disrupts Thousands of U.S. Users