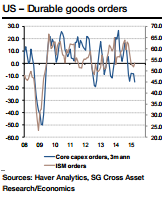

After two quarters of weakness, US durable goods orders are expected to show a bottoming in capex spending.

The manufacturing ISM rose modestly in May and the diffusion index for new orders has now posted two back-to-back increases. This is consistent with analysts' view that the capex cuts in the oil & gas sector should begin to subside and fully dissipate during the summer months.

Societe Generale projects a 0.8% m/m increase in total bookings in May and a 1.0% m/m rise in orders excluding transportation. The projections are consistent with the tentative signs of bottoming in the manufacturing sector observed in the survey data.

"The drag from the dollar is likely to be more persistent, but on balance we look for a reacceleration in equipment spending growth in the second half of the year to about 5.8%, up from a 1.7% average over the past two quarters", added Societe Generale.

Gold and Silver Prices Slide as Dollar Strength and Easing Tensions Weigh on Metals

Gold and Silver Prices Slide as Dollar Strength and Easing Tensions Weigh on Metals  Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX  Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady

Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady  Russian Stocks End Mixed as MOEX Index Closes Flat Amid Commodity Strength

Russian Stocks End Mixed as MOEX Index Closes Flat Amid Commodity Strength  Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election

Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election  Silver Prices Plunge in Asian Trade as Dollar Strength Triggers Fresh Precious Metals Sell-Off

Silver Prices Plunge in Asian Trade as Dollar Strength Triggers Fresh Precious Metals Sell-Off  Thailand Inflation Remains Negative for 10th Straight Month in January

Thailand Inflation Remains Negative for 10th Straight Month in January  Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal

Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal  India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out

India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out