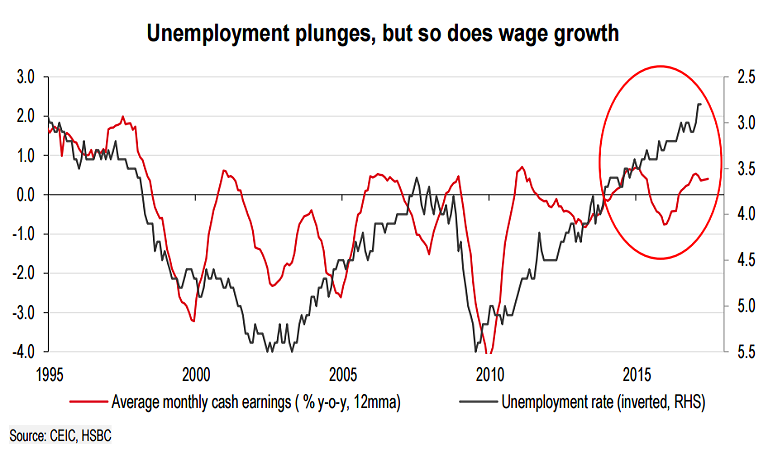

Japan real GDP is growing at an above-trend pace and the job market is on fire with labour market conditions at levels not seen for several decades. However, underlying price pressures are just not building. Japanese companies remain cautious and wage growth and Bank of Japan's (BoJ) price target seems out of reach without higher income. Hence BoJ is likely to stay pat on its accommodative path in June.

The Bank of Japan is set to hold its monetary policy meeting this week. According to a DBS Bank research report, the central bank is likely to stand pat, maintaining its policy rate at -0.1 percent and the 10y JGB yield target at 0 percent. The BoJ is expected to sound more positive on the outlook of economic growth in its policy statement, citing the rebound in exports, recovery in investment and drop in the jobless rate.

The Japanese economy expanded for the fifth consecutive quarter at the start of the year, which marked the longest positive streak in more than a decade. Real GDP growth increased 1.0 percent q-o-q saar in 1Q17, accelerating from 1.4 percent in 4Q17, notably above the BoJ’s estimate of potential growth of 0.7 percent. While the first quarter GDP rate was downwardly revised to 1 percent from the preliminary estimate of 2.2 percent, it was mainly because of inventory destocking instead of softness in final demand. The high-frequency production and consumption data imply that the second quarter growth would be solid, noted DBS Bank.

That said, the central bank admits the softness in inflation. CPI prints remained in the range of 0 to 0.5 percent year-on-year through the January to April period, coming below the central bank’s target rate of 2 percent by a greater margin. The second quarter Tankan survey, which is set to come out in early-July, is expected to show that inflation expectations continue to be weak in the corporate sector. BoJ could lower its inflation forecast and postpone the 2 percent prices target again when it reviews the medium-term economic projections during its July meeting, stated DBS Bank.

"The BoJ’s price target seems out of reach without higher income, and thus it is likely to maintain an accommodative monetary policy stance to the extent that it can," said HSBC Global research in a report.

USD buying picks-up pace across the board as markets head into a 2-day FOMC meeting that commences today. USD/JPY finds stiff resistance at 200-DMA (110.40). Technical indicators are not conclusive, RSI flat-lined below 50 level and MACD still bias lower. We see further upside on break above 200-DMA. While break below major trendline support at 109.30 could see drag upto 108.13 (Apr 17 low).

FxWirePro's Hourly USD Spot Index was at 25.2937 (Neutral), while Hourly JPY Spot Index was at -75.6566 (Neutral) at 1230 GMT. For more details on FxWirePro's Currency Strength Index, visit http://www.fxwirepro.com/currencyindex.

Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target

Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target  Federal Reserve Faces Subpoena Delay Amid Investigation Into Chair Jerome Powell

Federal Reserve Faces Subpoena Delay Amid Investigation Into Chair Jerome Powell  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal  Gold and Silver Prices Slide as Dollar Strength and Easing Tensions Weigh on Metals

Gold and Silver Prices Slide as Dollar Strength and Easing Tensions Weigh on Metals  Silver Prices Plunge in Asian Trade as Dollar Strength Triggers Fresh Precious Metals Sell-Off

Silver Prices Plunge in Asian Trade as Dollar Strength Triggers Fresh Precious Metals Sell-Off  Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility

Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility  U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains

U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains  South Korea Assures U.S. on Trade Deal Commitments Amid Tariff Concerns

South Korea Assures U.S. on Trade Deal Commitments Amid Tariff Concerns