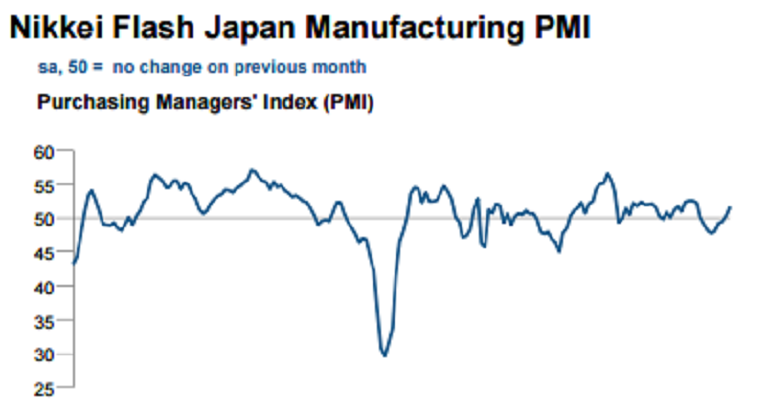

Manufacturing conditions in Japan rose at the fastest pace in nine months during the period of October, helped by a surge in sales, which have risen for the first time since January this year. A reading above 50 indicates expansion, while below the mark represents contraction in manufacturing activity.

Japan's flash manufacturing Purchasing Managers’ Index (PMI) rose to 51.7 in October, compared to 50.4 in September, data released by IHS Markit showed Monday. Also, flash Japan Manufacturing Output Index jumped to 53.7 in October, from 50.8 in September, with production increasing at the fastest rate since December 2015.

Published on a monthly basis approximately one week before final PMI data are released, this makes the PMI the earliest available indicator of manufacturing sector operating conditions in Japan. The estimate is typically based on approximately 85-90 percent of total PMI survey responses each month and is designed to provide an accurate indication of final PMI data, reports from HIS Markit confirmed.

Further, the data suggested that a strong expansion in foreign demand led to the rise in total new orders, as new exports rose at the fastest rate in nine months.

"Not surprisingly, goods producers were more confident to take on additional workers, with the rate of job hiring picking up to a two-and-a-half year high. Firms also benefitted from lower cost burdens, as input prices declined," said Amy Brownbill, Economist, HIS Markit.

Silver Prices Plunge in Asian Trade as Dollar Strength Triggers Fresh Precious Metals Sell-Off

Silver Prices Plunge in Asian Trade as Dollar Strength Triggers Fresh Precious Metals Sell-Off  Oil Prices Slide on US-Iran Talks, Dollar Strength and Profit-Taking Pressure

Oil Prices Slide on US-Iran Talks, Dollar Strength and Profit-Taking Pressure  Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal

Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal  U.S. Stock Futures Slide as Tech Rout Deepens on Amazon Capex Shock

U.S. Stock Futures Slide as Tech Rout Deepens on Amazon Capex Shock  Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election

Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election  Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target

Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target  Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran

Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran  South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom  India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out

India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out  Vietnam’s Trade Surplus With US Jumps as Exports Surge and China Imports Hit Record

Vietnam’s Trade Surplus With US Jumps as Exports Surge and China Imports Hit Record