Production in Japan increased at the sharpest rate in ten months, supported by a return to new order growth. International demand also picked up, with new export orders increasing at the quickest rate since January. On the price front, both input prices and charges declined at weaker rates.

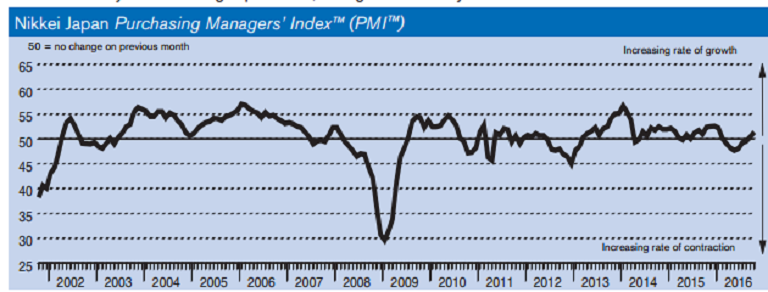

The headline Nikkei Japan Manufacturing Purchasing Managers’ Index (PMI) posted at 51.4 in October, up from 50.4 in September, signaling an improvement in operating conditions at Japanese manufacturers. In fact, the latest reading was the highest since January and greater than the long-run series average at 50.6.

Total new orders rose for the first time since January during October. According to a number of surveyed respondents, the launching of new products and success in gaining new customers helped boost new orders.

Japanese manufacturers were more confident to take on additional workers, with the rate of job hiring accelerating to a 30-month high. Buying activity remained in contraction territory, but only just. Meanwhile, goods producers continued to benefit from lower cost burdens, as input prices decreased for the tenth consecutive month.

Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility

Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Gold Prices Slide Below $5,000 as Strong Dollar and Central Bank Outlook Weigh on Metals

Gold Prices Slide Below $5,000 as Strong Dollar and Central Bank Outlook Weigh on Metals  Oil Prices Slide on US-Iran Talks, Dollar Strength and Profit-Taking Pressure

Oil Prices Slide on US-Iran Talks, Dollar Strength and Profit-Taking Pressure  South Korea’s Weak Won Struggles as Retail Investors Pour Money Into U.S. Stocks

South Korea’s Weak Won Struggles as Retail Investors Pour Money Into U.S. Stocks  Russian Stocks End Mixed as MOEX Index Closes Flat Amid Commodity Strength

Russian Stocks End Mixed as MOEX Index Closes Flat Amid Commodity Strength  Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality

Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality  FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022  South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom