More than two-thirds of Japanese companies believe the domestic economy will suffer as relations with China continue to deteriorate, according to a recent Reuters survey conducted by Nikkei Research. Nearly half of the firms surveyed said they have already experienced or expect to face a direct business impact from the worsening Japan-China relationship, underscoring growing economic and geopolitical risks in Asia.

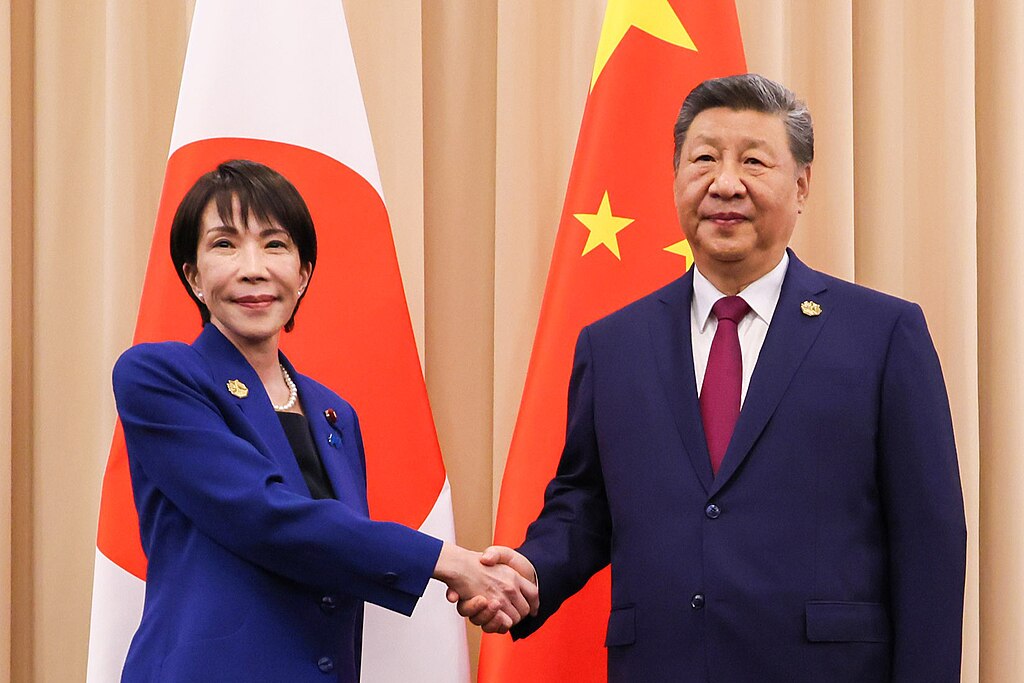

Tensions escalated after Prime Minister Sanae Takaichi stated in November that a potential Chinese attack on Taiwan could pose an existential threat to Japan, a comment China condemned as provocative. China, which considers Taiwan part of its territory, has since advised its citizens against traveling to Japan and imposed export restrictions on items with potential military applications. These moves have raised concerns among Japanese businesses, particularly about possible curbs on rare-earth exports, which are critical to the automotive and electronics industries. Despite Japan’s efforts to diversify supply chains, China still accounts for roughly 60% of Japan’s rare-earth imports.

The survey revealed that about 9% of respondents have already seen their business affected, while 35% anticipate future disruption. Companies in tourism, manufacturing, and transportation reported declining Chinese visitor numbers, supply chain uncertainty, and potential revenue losses. Several firms indicated they may reassess or reduce their China-related business exposure if bilateral relations continue to deteriorate.

The poll also explored views on Japan’s monetary policy. Around two-thirds of respondents said the Bank of Japan’s recent interest rate hike to 0.75%, the highest level in three decades, was appropriate. However, others warned higher rates could dampen capital investment, especially for debt-heavy firms. Opinions on the timing of the next rate hike were divided, with many favoring gradual tightening to balance inflation control and economic growth.

Overall, the survey highlights how geopolitical tensions with China and shifting monetary policy are reshaping business sentiment in Japan, raising concerns about trade, investment, and long-term economic stability.

Trump Endorses Japan’s Sanae Takaichi Ahead of Crucial Election Amid Market and China Tensions

Trump Endorses Japan’s Sanae Takaichi Ahead of Crucial Election Amid Market and China Tensions  Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm

Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm  Missouri Judge Dismisses Lawsuit Challenging Starbucks’ Diversity and Inclusion Policies

Missouri Judge Dismisses Lawsuit Challenging Starbucks’ Diversity and Inclusion Policies  U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains

U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains  Ohio Man Indicted for Alleged Threat Against Vice President JD Vance, Faces Additional Federal Charges

Ohio Man Indicted for Alleged Threat Against Vice President JD Vance, Faces Additional Federal Charges  Oil Prices Slide on US-Iran Talks, Dollar Strength and Profit-Taking Pressure

Oil Prices Slide on US-Iran Talks, Dollar Strength and Profit-Taking Pressure  Thailand Inflation Remains Negative for 10th Straight Month in January

Thailand Inflation Remains Negative for 10th Straight Month in January  Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran

Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran  Nighttime Shelling Causes Serious Damage in Russia’s Belgorod Region Near Ukraine Border

Nighttime Shelling Causes Serious Damage in Russia’s Belgorod Region Near Ukraine Border  Silver Prices Plunge in Asian Trade as Dollar Strength Triggers Fresh Precious Metals Sell-Off

Silver Prices Plunge in Asian Trade as Dollar Strength Triggers Fresh Precious Metals Sell-Off  India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out

India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out  Federal Judge Restores Funding for Gateway Rail Tunnel Project

Federal Judge Restores Funding for Gateway Rail Tunnel Project  Trump Signs “America First Arms Transfer Strategy” to Prioritize U.S. Weapons Sales

Trump Signs “America First Arms Transfer Strategy” to Prioritize U.S. Weapons Sales  U.S. Lawmakers to Review Unredacted Jeffrey Epstein DOJ Files Starting Monday

U.S. Lawmakers to Review Unredacted Jeffrey Epstein DOJ Files Starting Monday  Russian Stocks End Mixed as MOEX Index Closes Flat Amid Commodity Strength

Russian Stocks End Mixed as MOEX Index Closes Flat Amid Commodity Strength  Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal

Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal  U.S. Announces Additional $6 Million in Humanitarian Aid to Cuba Amid Oil Sanctions and Fuel Shortages

U.S. Announces Additional $6 Million in Humanitarian Aid to Cuba Amid Oil Sanctions and Fuel Shortages