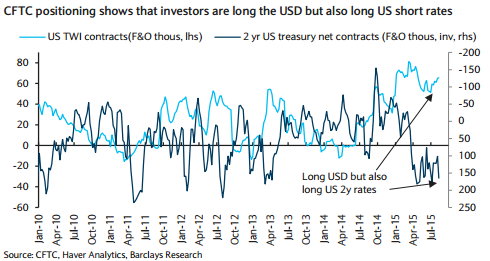

In terms of positioning, USD longs are still near peak levels with every currency net short versus the dollar currently, suggesting investors are positioned for a Fed hike in FX markets. Barclays expects the Fed's rate hike in September, investors remain divided over the timing of the hike.

On the other hand, net longs in US 2y rates are at very high levels. Positioning in eurodollar futures is also modestly net long when it has been net short around the 1999 and 2004 hiking cycles as well as the taper tantrum. "Given the positioning disconnect, it appears that short rates may be the better option to position for Fed hikes rate", suggests Barclays.

Investors positioned for Fed hikes in FX

Thursday, August 20, 2015 5:41 AM UTC

Editor's Picks

- Market Data

Most Popular

RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist

RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist  FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022  Fed Confirms Rate Meeting Schedule Despite Severe Winter Storm in Washington D.C.

Fed Confirms Rate Meeting Schedule Despite Severe Winter Storm in Washington D.C.  Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX