In addition to the stock market turbulence, August was marked by uncertainty in the Chinese currency market. On 11 August the People's Bank of China (PBoC) effectively devalued the CNY by setting the daily fixing rate 1.9% lower versus the USD, notes Nordea Bank.

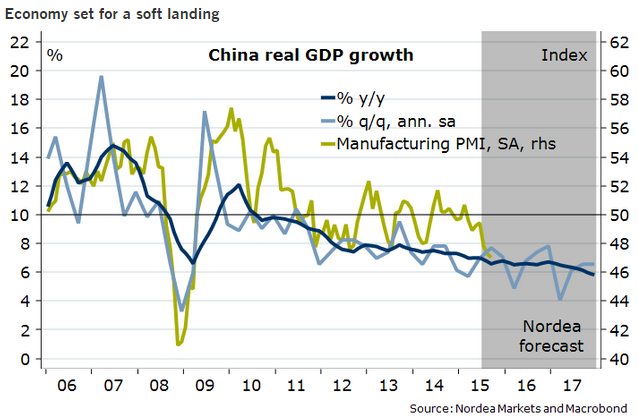

Despite the financial market turmoil, we still see a soft landing as the most plausible scenario in the coming two years. As we have highlighted in "China 3.0 - decades of structural slowdown", Chinese growth will continue falling due to structural constraints such as a shrinking labour force, diminishing returns on capital and maturing productivity growth.

In addition, adjustments will have to be made to reduce overcapacity and clean up corporate balance sheets. These adjustments will dampen domestic demand. But the authorities remain stability obsessed when it comes to growth. Driven by fears of a sharp slowdown, they will likely delay the structural adjustments in the coming two years and use the "old normal" approach to support the economy, that is, rely on credit expansion and public investment.

"Investment in China is expected to grow at a faster pace than the overall economy in 2015 and 2016. Monetary conditions will be kept loose to facilitate this. We expect one more rate cut of 25bp and two RRR cuts of 50bp this year. The policy support will likely offset some of the structural pressure and we forecast GDP growth at 6.8% this year and 6.6% in 2016", aggues Nordea Bank.

Investment in China to grow at faster pace than overall economy

Friday, September 25, 2015 7:15 AM UTC

Editor's Picks

- Market Data

Most Popular

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed