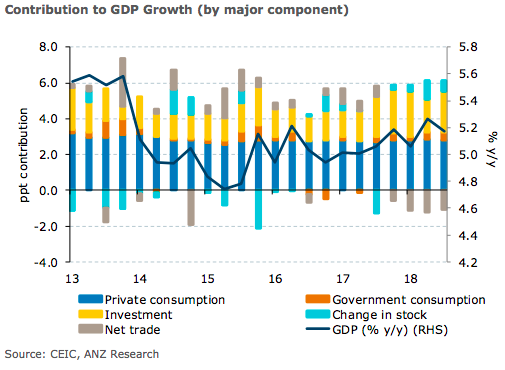

Indonesia’s growth slowed slightly from 5.27 percent y/y in Q2 to 5.17 percent in the third quarter of this year, which was broadly in line with expectations. Investment was a key driver of growth, with its pace of expansion picking up from 5.86 percent y/y in Q2 to 6.96 percent in Q3.

Government consumption growth also accelerated during the same period. Private consumption growth slowed, but it remained solid by recent standards. Inventories also provided a smaller lift to growth.

Meanwhile, export growth edged down, though a sharper moderation in import growth meant that net trade was a slightly smaller drag on growth in Q3 as compared to the quarter before. In year-to-date terms, GDP growth came in at 5.17 percent y/y, which suggests that ANZ Research’s full-year growth forecast for 2018 of 5.2 percent percent remains on track.

While the policy response to the weakening of the IDR in recent months has helped stabilise the currency, it is likely to be a constraint on growth. For instance, government measures to reduce imports by raising tariffs on selected consumer goods and delay import-intensive infrastructure projects will dampen domestic demand.

"Tightening liquidity conditions following the central bank’s cumulative 150bps in rate hikes since May also present a headwind to growth. Today’s GDP data is unlikely to have much bearing on monetary policy, which will continue to be driven by movements in the IDR. Recent gains in the IDR suggest Bank Indonesia (BI) is likely to stay on hold at its meeting next week," ANZ Research commented.

Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal

Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal  China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices  Russian Stocks End Mixed as MOEX Index Closes Flat Amid Commodity Strength

Russian Stocks End Mixed as MOEX Index Closes Flat Amid Commodity Strength  U.S. Stock Futures Slide as Tech Rout Deepens on Amazon Capex Shock

U.S. Stock Futures Slide as Tech Rout Deepens on Amazon Capex Shock  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Gold and Silver Prices Climb in Asian Trade as Markets Eye Key U.S. Economic Data

Gold and Silver Prices Climb in Asian Trade as Markets Eye Key U.S. Economic Data  Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm

Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm