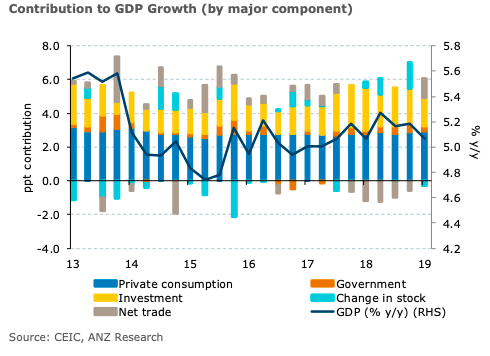

Indonesia’s growth in gross domestic product (GDP) eased during the first quarter of this year, broadly in line with expectations. While government spending growth picked up ahead of the April elections, and private consumption growth edged up, these were offset by a pullback in investment growth and a slump in exports.

The country’s growth slowed from 5.18 percent y/y in Q4 to 5.07 percent y/y in Q1, the softest reading in a year. The breakdown showed a slump in exports (-2.08 percent y/y), though a sharper fall in imports (7.75 percent) meant that net exports were a positive contributor to headline growth.

Government spending growth picked up from 4.56 percent y/y in Q4 to 5.21 percent y/y to Q1 ahead of the April elections, while private consumption growth (including non-profit institutions serving households) edged up slightly.

However, there was a significant pullback in investment growth from 6.01 percent to 5.03 percent, the slowest pace in two years. Meanwhile, inventories were a drag on growth in Q1 after providing a considerable boost the quarter before.

Looking ahead, domestic demand will be a key support to economic activity, but slowing global growth and weak prices for Indonesia’s key commodity exports such as coal and palm oil are impediments to faster growth. Lower export revenues would constrain firms’ profitability, the government’s revenues, and (potentially) workers’ incomes. Accordingly, Indonesia’s GDP growth is likely to remain stuck around the 5 percent-mark, ANZ Research noted its latest report.

"Today’s weak data strengthens the case for BI to lower its policy rate, and our base case is for two 25bps worth of cuts this year. BI has signalled a rising emphasis on supporting growth, as reflected by its announcement of a range of accommodative policies at its last monetary policy meeting in April. That said, the recent volatility in the rupiah suggests an imminent move at BI’s upcoming meeting on May 16 is unlikely," the report further commented.

FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022  Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns

Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns  Oil Prices Slide on US-Iran Talks, Dollar Strength and Profit-Taking Pressure

Oil Prices Slide on US-Iran Talks, Dollar Strength and Profit-Taking Pressure  Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran

Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran  Australian Household Spending Dips in December as RBA Tightens Policy

Australian Household Spending Dips in December as RBA Tightens Policy  Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility

Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility  South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom  Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal

Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal  Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election

Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election