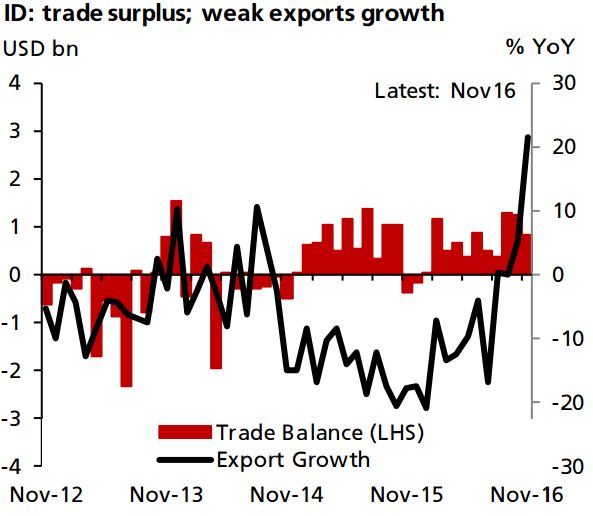

Indonesian trade balance data for December is expected to be released on Monday, January 16 at 04:00 GMT. We foresee that the trade surplus will increase to USD8 billion, higher than the precious reading of USD7.7 billion, supported by the stronger growth in the country’s exports of around 7 percent y/y. The acceleration in export growth in the last-quarter of 2016 was definitely encouraging for the outlook on external balances this year.

Some moderation in the trade surplus may happen this year. Last year’s trade surplus was pretty much a function of poor import growth. As import growth seems to have bottomed out in the last-quarter of 2016, trade balance will come under pressure without help from export growth, reported DBS Group Research.

Also, it is expected that the recovery in energy prices will support the outlook for export growth in the near future. Also, the low base effects from last year shall help.

It is worth noting that the market will primarily focus on the numbers of exports of manufactured goods as its growth has underperformed the region in recent years and it remains to be seen if a catch-up is in the offing this year.

Meanwhile, USD/IDR traded 0.36 percent higher at 13,306 by around 07:00 GMT. Also, 10-year bond yields fell 7 basis points to 7.52 percent.

Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal

Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal  Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran

Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran  Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns

Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns  South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom  Oil Prices Slip as U.S.-Iran Talks Ease Middle East Tensions

Oil Prices Slip as U.S.-Iran Talks Ease Middle East Tensions  Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility

Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility  Lee Seung-heon Signals Caution on Rate Hikes, Supports Higher Property Taxes to Cool Korea’s Housing Market

Lee Seung-heon Signals Caution on Rate Hikes, Supports Higher Property Taxes to Cool Korea’s Housing Market  Vietnam’s Trade Surplus With US Jumps as Exports Surge and China Imports Hit Record

Vietnam’s Trade Surplus With US Jumps as Exports Surge and China Imports Hit Record  Asian Markets Surge as Japan Election, Fed Rate Cut Bets, and Tech Rally Lift Global Sentiment

Asian Markets Surge as Japan Election, Fed Rate Cut Bets, and Tech Rally Lift Global Sentiment