The UK's October Manufacturing PMI rose to 55.5, after a marginal upward revision to 51.8 in September. The overall index was upbeat at a 16-month high, considerably above market expectations.

The output index accelerated to 58.3 (+5.2pp) as new orders recorded a jump to 56.9 (+4.0pp), its highest level since July 2014, with the subcomponent new export orders picking up marginally less by 1.3pp (to 52.0).

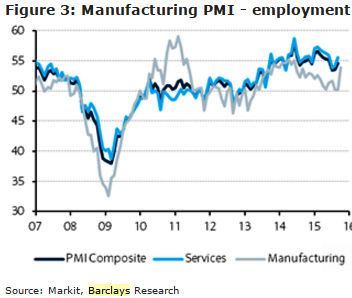

This highlights that while recently seen export orders improving at the expense of domestic orders, the release indicates domestic orders were in fact the primary driver of the resurgence. The employment index also improved considerably (+3.7pp), touching a 17-month high.

Cost pressures continued as prices remained mired in contractionary territory. Input prices posted a slight recovery but remained low at 39.7 and however declined on a 3mma/3mma basis, while output prices edged lower to 48.0 (-0.7pp).

"While the strong upside surprise is potentially welcome news for the outlook of the UK's manufacturing industry, it has not been felt across all sectors. Of concern is that this upside surprise is confined solely to large firms, according to the Markit press release, while SMEs (accounting for approximately 50% of UK GVA) reported similar levels to September or even marginal declines", says Barclays.

On employment, again the rise was due to larger firms, which reported a lack of capacity to meet orders, while SMEs reported no change in employment levels or expectations.

Further, continued weakness in input and output prices, both significantly below their long-term averages and showing continued quarterly declines, signals more inflationary weakness is in the pipeline and bodes ill for expectations of a quick normalisation in inflation towards 2%.

This is consistent with the view that October inflation will dip to -0.2% y/y from -0.1% y/y in September, and hover around 0% till the end of 2015. Overall, despite today's release, it remain cautious in light of the inconsistency among different firm sizes and sectors, and more consistency should be seen among firms before welcoming the rise.

"Furthermore, today's PMI release does not affect the view on the BoE's policy decision, a lift-off is likely by Q2 16, after the Fed's lift-off, which migth be in March 2016", added Barclays.

Good news for UK's larger firms, less so for SMEs

Tuesday, November 3, 2015 3:14 AM UTC

Editor's Picks

- Market Data

Most Popular

Trump Endorses Japan’s Sanae Takaichi Ahead of Crucial Election Amid Market and China Tensions

Trump Endorses Japan’s Sanae Takaichi Ahead of Crucial Election Amid Market and China Tensions  India Services Sector Rebounds in January as New Business Gains Momentum: HSBC PMI Shows Growth

India Services Sector Rebounds in January as New Business Gains Momentum: HSBC PMI Shows Growth  Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX  Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady

Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady  Oil Prices Slide on US-Iran Talks, Dollar Strength and Profit-Taking Pressure

Oil Prices Slide on US-Iran Talks, Dollar Strength and Profit-Taking Pressure  Asian Markets Slip as AI Spending Fears Shake Tech, Wall Street Futures Rebound

Asian Markets Slip as AI Spending Fears Shake Tech, Wall Street Futures Rebound  US-India Trade Bombshell: Tariffs Slashed to 18% — Rupee Soars, Sensex Explodes

US-India Trade Bombshell: Tariffs Slashed to 18% — Rupee Soars, Sensex Explodes  Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election

Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election  Trump Administration Sued Over Suspension of Critical Hudson River Tunnel Funding

Trump Administration Sued Over Suspension of Critical Hudson River Tunnel Funding  U.S. Stock Futures Edge Higher as Tech Rout Deepens on AI Concerns and Earnings

U.S. Stock Futures Edge Higher as Tech Rout Deepens on AI Concerns and Earnings