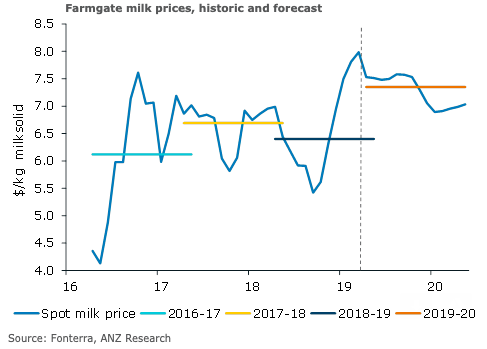

Global dairy prices are expected to remain at $6.40/kg MS for 2018-19 season, while projecting stronger returns for the next season at $7.30/kg MS, according to the latest report from ANZ Research.

Fonterra is on track to finalise its milk price for the 2018-19 season within its current forecast guidance range of $6.30-$6.60/kg milksolid (MS). Dairy markets have strengthened over the past six months on the back of improved returns for dairy commodities and a softer New Zealand dollar.

This price assumes dairy commodity prices will hold near current levels for the remainder of the 2019 calendar year, then ease slightly in the later part of the season. The exchange rate assumption is aligned with ANZ’s view that the NZD will continue to weaken against the USD, easing back to USD0.64 by the end of 2019.

"We expect Fonterra will forecast a range of $6.50-$7.50/kg MS," the report added.

The exchange rate used in ANZ’s forecast calculation takes into account Fonterra’s assumed hedging policy, which implies a delay in the impact of movements of the NZD on the farmgate milk price. The effective exchange rate used in the forecasts is USD0.665.

Meanwhile, the 2019-20 forecast is based on a weighted whole milk powder (WMP) price of USD3140/t for next season. This is slightly below the price at which WMP is currently trading.

Asian Currencies Stay Rangebound as Yen Firms on Intervention Talk

Asian Currencies Stay Rangebound as Yen Firms on Intervention Talk  Gold and Silver Prices Climb in Asian Trade as Markets Eye Key U.S. Economic Data

Gold and Silver Prices Climb in Asian Trade as Markets Eye Key U.S. Economic Data  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal  Australian Household Spending Dips in December as RBA Tightens Policy

Australian Household Spending Dips in December as RBA Tightens Policy  Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target

Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target  China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices  Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility

Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility  FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022  Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal

Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal  U.S. Stock Futures Rise as Markets Brace for Jobs and Inflation Data

U.S. Stock Futures Rise as Markets Brace for Jobs and Inflation Data