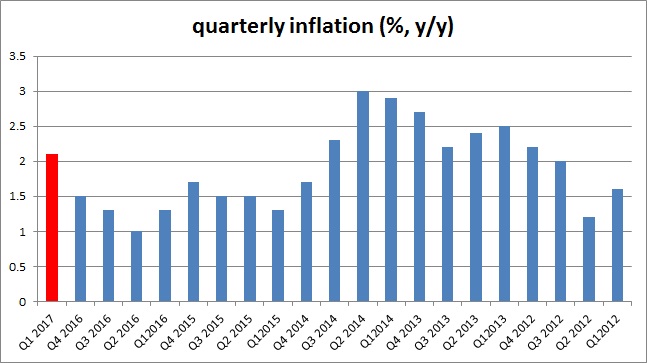

The Reserve Bank of Australia’s (RBA) monetary policy has a duty to maintain price stability, full employment, economic prosperity and the welfare of the Australian people and to achieve these targets RBA maintain an inflation target of 2-3 percent.

Data released earlier shows that for the first time since 2014, the inflation has reached the RBA’s target range. In the first quarter of 2017, CPI inflation in Australia increased by 2.1 percent from a year ago. Inflation grew by 0.5 percent on a quarterly basis. RBA’s own measure of trimmed mean CPI, which is more of core inflation, grew by 1.9 percent in the first quarter from a year ago. The increase in commodity prices through 2016 and in initial months of 2017 is a contributor to the increase.

However, we don’t expect the RBA to change its policy stance in the first half of the year. The recent slide in commodity prices has already pushed back rising inflation in other key economies like in Germany. Australia may suffer the same fate. In addition to that, the policymakers at the RBA would prefer for the inflation to settle in the middle of the range at least for two to three quarters before they start to change their current wait and watch policy. Currently, RBA is maintaining interest rates at 1.5 percent.

The Australian dollar is currently trading at 0.752, down -0.16 percent so far today.

Jerome Powell Attends Supreme Court Hearing on Trump Effort to Fire Fed Governor, Calling It Historic

Jerome Powell Attends Supreme Court Hearing on Trump Effort to Fire Fed Governor, Calling It Historic  Gold and Silver Prices Slide as Dollar Strength and Easing Tensions Weigh on Metals

Gold and Silver Prices Slide as Dollar Strength and Easing Tensions Weigh on Metals  Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility

Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility  South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom  Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm

Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm  Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility

Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal  MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks

MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks  Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX  Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target

Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target  China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices