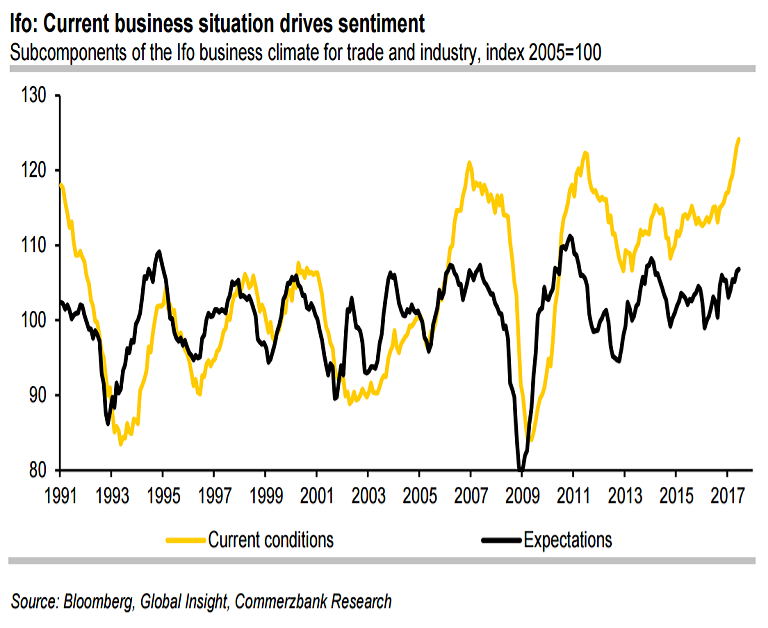

The Munich-based Ifo institute’s business climate index rose to 115.1 in June from 114.6 in May, exceeding analysts expectations for a value of 114.4. Ifo’s two sub-indices measuring current conditions and future expectations also beat forecasts, rising to 124.1 and 106.8 respectively. The unexpected improvement was the latest sign of confidence in Europe’s economic recovery.

German business confidence hits new record high in June showing that German businesses were feeling more positive than ever this month. Purchasing Managers’ Indexes data released last week showed that momentum in German manufacturing remained close to the highest level since 2011. Germany’s economy is gaining momentum, with unemployment at a record low and economic expansion of 0.6 percent in Q1, experts are expecting the positivity to continue.

“Sentiment among German businesses is jubilant,” Ifo President Clemens Fuest said in a statement. “Germany’s economy is performing very strongly.”

Earlier in June, Germany’s central bank raised its economic outlook through 2019, arguing that increasing employment, consumer spending and construction would ensure an “ongoing solid underlying pace” of expansion. Last week Ifo also upgraded its economic growth forecasts for Germany for this year and next.

That said, there are indeed factors that could slow the German economy and thus business sentiment to some extent in the coming months. The euro has appreciated somewhat in recent weeks which could dent German exports. Moreover, the global economy seems to be losing some steam as shown by the global manufacturing PMI which has recently fallen. However, the fact that German business expectations have continued rising argues against a sharp fall in the near future.

"Chances of a good H2 for the German economy are becoming better and better as the surge of the Ifo continues," said Commerzbank in a report.

EUR/USD was trading at 1.1175 at around 1115 GMT. The major remains capped below 1.1202 which is stiff resistance. 5-DMA at 1.1164 is immediate support on the downside. Technical indicators on daily charts are neutral. Upside momentum is fading on weekly charts. Break below 5-DMA at 1.1164 could drag the pair lower. Test of 50-day MA at 1.1065 then likely.

FxWirePro launches Absolute Return Managed Program. For more details, visit http://www.fxwirepro.com/invest.

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices  Thailand Inflation Remains Negative for 10th Straight Month in January

Thailand Inflation Remains Negative for 10th Straight Month in January  Trump Endorses Japan’s Sanae Takaichi Ahead of Crucial Election Amid Market and China Tensions

Trump Endorses Japan’s Sanae Takaichi Ahead of Crucial Election Amid Market and China Tensions  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal

Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal  Gold and Silver Prices Rebound After Volatile Week Triggered by Fed Nomination

Gold and Silver Prices Rebound After Volatile Week Triggered by Fed Nomination  Vietnam’s Trade Surplus With US Jumps as Exports Surge and China Imports Hit Record

Vietnam’s Trade Surplus With US Jumps as Exports Surge and China Imports Hit Record  Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election

Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election  Silver Prices Plunge in Asian Trade as Dollar Strength Triggers Fresh Precious Metals Sell-Off

Silver Prices Plunge in Asian Trade as Dollar Strength Triggers Fresh Precious Metals Sell-Off  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate