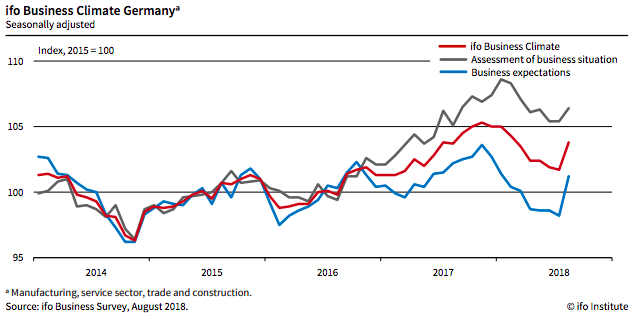

Business confidence in German firms has improved noticeably. The ifo Index rose to 103.8 points in August after 101.7 points in July. The companies were once again more satisfied with their current business situation. Business expectations were revised noticeably upwards. In addition to a robust domestic economic situation, the truce in the trade conflict with the US contributed to improved business confidence.

The German economy is performing robustly. Current figures point to economic growth of 0.5 percent in the third quarter. In manufacturing, the index has risen after six consecutive declines. The rise was due to the clearly more optimistic expectations of the surveyed companies, especially in the automotive industry. Companies are increasingly planning to step up production.

By contrast, the very favourable current business situation was rated a little less positively. In the services sector, the business climate has improved significantly. The service providers were more satisfied with their current business situation. Their expectations were noticeably more optimistic. The rise in the expectation component was as steep as it last was in June 2009. In trade, the index has risen slightly.

Although retailers and wholesalers were a bit less satisfied with their current situation than in the previous month, scepticism about the six-month business outlook declined somewhat. In construction, the business climate index continued at its record pace. The contractors were somewhat more satisfied with their current situation. In addition, they are much more optimistic regarding the coming half year.

Meanwhile, EUR/USD traded nearly flat at 1.1616 at the time of writing during Monday’s European session.

Australian Pension Funds Boost Currency Hedging as Aussie Dollar Strengthens

Australian Pension Funds Boost Currency Hedging as Aussie Dollar Strengthens  Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX  Russian Stocks End Mixed as MOEX Index Closes Flat Amid Commodity Strength

Russian Stocks End Mixed as MOEX Index Closes Flat Amid Commodity Strength  Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility

Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility  Asian Currencies Stay Rangebound as Yen Firms on Intervention Talk

Asian Currencies Stay Rangebound as Yen Firms on Intervention Talk  Gold and Silver Prices Climb in Asian Trade as Markets Eye Key U.S. Economic Data

Gold and Silver Prices Climb in Asian Trade as Markets Eye Key U.S. Economic Data  Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility

Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility