The Japanese yen has been the best-performing currency this year until recently, just before speculations over fresh stimulus from Bank of Japan (BoJ) went rampant. The yen is currently trading at 105.5 per dollar, down almost 700 pips from the bottom around 98.7, made post-UK referendum. Let’s look at how the yen has fared as a safe haven.

Japanese yen vs. British sterling:

This is the top risky asset at the moment since the British voters favored exit in June 23rd referendum. This year, the yen has been showing considerable high correlation with the sterling and the trend is pointing to a rise. The 20-day rolling correlation is on a rising path and steadily making lower lows and higher highs. In the latest run, the correlation between USD/JPY and GBP has jumped from 0 percent on the day of the referendum to 85 percent on July 11th. This shows the safe haven status of the yen remains strong but declining recently over BoJ speculations.

Japanese yen vs. S&P500:

This relation shows while the yen is doing well during turmoil in equities (correlation reached 79 percent just after the referendum but as equities started rallying the correlation dropped, which means equity rallies are just not enough to weaken the yen, which they add to its strength in decline.

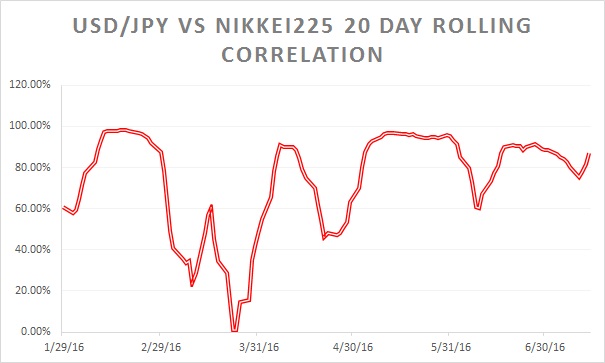

Japanese yen vs. Nikkei225:

USD/JPY and Nikkei 225 have been showing a very high level of correlation this year. At one point in February, 20-day rolling correlation was close to 100 percent. Since May, the correlation hasn’t dropped below 60 percent and is currently at 87 percent. So if BoJ doesn’t provide next level of stimulus, it is likely to be terrible for Nikkei225.

Japanese yen vs. WTI crude:

Since the oil price started recovering from February, other than some occasional rise in relation, oil hasn’t been much of an influencing factor. Since the mid of May, the average correlation of the Japanese yen with the WTI crude has been 42 percent, compared to 64 percent with the sterling and 86 percent with Nikkei 225.

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed