The semi-annual Congressional testimony of Fed chair Janet Yellen was the most important event of this week – so far. Not surprisingly, it did not reveal anything new in comparison to the minutes of the FOMC’s June meeting: Inflation will be the key factor for any decisions about rate hikes. This means that the June consumer price inflation data, which are due today, are the real highlight of the week. They will determine the trend of the USD for now, particularly since the data calendar for next week is relatively light and the Fed members will stay mum from tomorrow ahead of their July meeting.

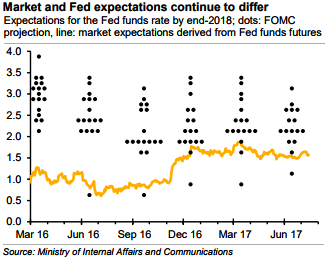

The gap between market expectations and Fed projections will shape the future path of the USD (refer above chart). Depending on how this gap is closed – i.e. on whether the market moves towards the Fed or the Fed towards the market – the dollar would appreciate or not. The Fed believes that it will be able to continue its rate hike course at roughly the same pace next year, provided that inflation accelerates as expected. And that is exactly what the market doubts, seeing that inflation disappointed in recent months.

As a result, the market expectations are much more cautious – and weighing on the USD.

EM currencies suffered, rates increased, and curves steepened when US 10yr yields recently hovered close to 2.4%. While the risks of a yield shock have dissipated, they could re-surface at any time. We review our analysis of what typically happens to emerging market assets during periods when US yields rise significantly.

Swap rates in the CNY, TRY, and ZAR tend to rise the most when US yields are moving markedly higher, while RUB and MYR swap curves tend to steepen the most. Underperforming currencies in EM were TRY, MYR, and INR during US rate rises.

The constructive outlook on EMFX is encouraged with Yellen’s dovish testimony bolstering sentiment. We remain short USDCLP, USDTHB, and USDTRY, and will look to add risk going forward.

In sovereign credit, valuations are quite tight. We scaled back duration exposure and revised our country allocation in favor of CEE countries.

Trade highlights

FX: USDRUB appearing call spread, stat long 08-Dec-17 USDRUB call (59), spot ref: 57.00

FX: Short USDTHB

Rates: Pay CZK 10y IRS.

Fetch positive carry from shorting USDCNH FX swap, when to protect upside risks via USD ATM call option and when to prefer NDFs.

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom  RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says

RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025