We reckon that it is premature to crown the dollar king and extrapolate continued broad USD strength into and through the second half of the year. Cyclical divergence, while still favouring the USD, is narrowing. As USDJPY was well anticipated for price spikes in short run, the pair has significantly risen from the lows of 104.629 levels to the recent highs of 112.420 levels amid the major downtrend, we’ve already advocated diagonal put ratio back spread about a fortnight ago.

Diagonal Put Ratio Back Spread as Volatility Trading Strategy Amid Bearish Scenarios:

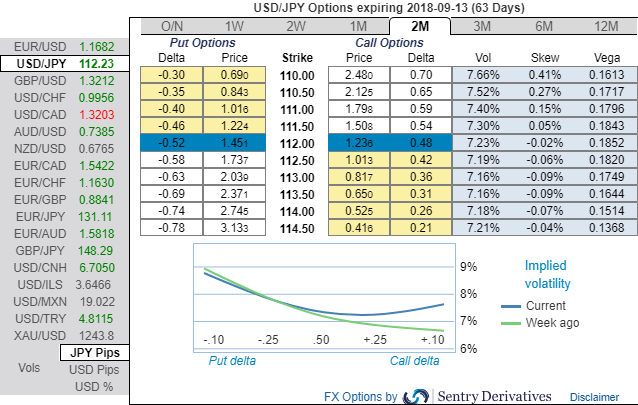

The execution: If you ponder upon cost effectiveness and wouldn’t like to divert exposure, we advocate buying USDJPY 2w/2m put ratio back spread strikes 112.634/110.595 (2 lots), (vanilla: 0.75%, spot ref: 112.330). A 2:1 put back spread can be implemented by buying a number of puts at a higher strike and buying twice the number of puts at a lower strike.

Rationale: The implied volatility of ATM contracts of USDJPY is trading back towards 7.01% and 7.66% for 2w/2m tenors respectively, as the positively skewed IVs of 2m tenors signify the hedging sentiments for the further downside risks over the period of time, this appears to be conducive for put option holders. On the flip side, it is wise to utilize abrupt rallies amid shrinking vols in the below-stated options strategy.

The positively skewed implied volatilities of 2m tenors signify the hedging sentiments for the further downside risks, this appears to be conducive for put option holders.

This bearish sentiment is substantiated by the mounting negative risk reversal (RRs) numbers, and negative RRs indicate the hedging sentiments for the bearish risks appears to be intact.

What makes strategy more attractive: Short leg (ITM shorts) of this strategy would have fetched attractive yields as the underlying spot FX has significantly spiked above, while long legs are yet to function having two months of expiry.

The short leg with narrowed expiry likely to benefit time decay advantage which in turn reduces hedging cost on the long leg of ATM put.

Currency Strength Index: FxWirePro's hourly JPY spot index has shown -115 (which is bearish), while the hourly USD spot index was at 58 (bullish) while articulating at 07:29 GMT. For more details on the index, please refer below weblink:

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts