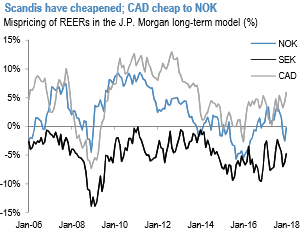

The largest G10 movers since our last publication in October were GBP and EUR (outperformed) while the underperformers were CAD and Scandis (unchanged vs USD). The dollar has weakened broadly versus all G10 currencies since then, weakening 1.3% in TWI terms.

Scandis have weakened and are now among the cheapest G10 currencies on this framework following the poor performance since October. Swedish Krone seems to be resilient and stable. The krone was hurt after the summer due to strong euro appreciation and a particularly dovish Riksbank communication. However, after testing and rejecting horizontal resistance at 10 in November 2016 and November 2017.

Norway and Sweden are experiencing strong growth but are at different stages of their cycles: Sweden’s expansion has decelerated, whereas Norway is playing catch-up. Meanwhile, Sweden’s housing market is probably a bigger risk than Norway’s. Real house prices have increased faster in Sweden, raising more financial stability risks and potentially a higher risk of a central bank policy mistake (the market has kept in mind the Riksbank’s dangerous tactic of ‘leaning against the wind’). Moreover, NOK rates have delivered decent carry, whereas SEK short rates are still anchored in negative territory.

Finally, NOK/SEK has likely formed a double-bottom just above parity, suggesting that the market is unwilling to go short the cross.

NOK has fallen down the ranks specifically since it hasn't kept up with the oil price increase. While NOK is not as mispriced as SEK, it is cheap relative to the other G10 petro FX, CAD (refer above chart).

The FX option prices are not priced in the unambiguously positive asymmetry of Swedish Krona spot outcomes. Prices of at-expiry digital (AED) options would be construed as probabilities of spot ending at or beyond strike thresholds at maturity, and are useful for studying the option-implied likelihood of spot outcomes.

One side-effect of the correction in EURUSD has been that PLN and SEK, both of which we like, have fallen further against the dollar than the euro has. That’s not a new pattern and points to heavy positioning, as many people bought ‘euro-alternatives’ rather than the real thing, earlier this year.

The starkly positive asymmetry of SEK spot outcomes is not reflected in option prices. Prices of at-expiry digital (AED) options can be interpreted as probabilities of spot ending at or beyond strike thresholds at maturity, and are useful for studying the option-implied likelihood of spot outcomes.

We favored buying zero-cost combinations of long EUR put/SEK call vs. short EUR call/SEK put digitals to position for an eventual normalization of Riksbank policy; we still maintain this position. At spot ref: 9.8415, 6M 9.7510 EUR put/SEK call vs 10.0320 EUR call/SEK put at-expiry digital risk-reversal has a net premium credit of 2.7% EUR (-5.2 /2.7 two-way indicative. assuming equal EUR notionals/leg). The short strike is above the YTD high, hence reasonable cushion against a backup on the spot.

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  Japan Declines Comment on BOJ’s Absence From Global Support Statement for Fed Chair Powell. Source: Asturio Cantabrio, CC BY-SA 4.0, via Wikimedia Commons

Japan Declines Comment on BOJ’s Absence From Global Support Statement for Fed Chair Powell. Source: Asturio Cantabrio, CC BY-SA 4.0, via Wikimedia Commons  RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says

RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  OCBC Raises Gold Price Forecast to $5,600 as Structural Demand and Uncertainty Persist

OCBC Raises Gold Price Forecast to $5,600 as Structural Demand and Uncertainty Persist  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  U.S. Urges Japan on Monetary Policy as Yen Volatility Raises Market Concerns

U.S. Urges Japan on Monetary Policy as Yen Volatility Raises Market Concerns  Morgan Stanley Raises KOSPI Target to 5,200 on Strong Earnings and Reform Momentum

Morgan Stanley Raises KOSPI Target to 5,200 on Strong Earnings and Reform Momentum  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure