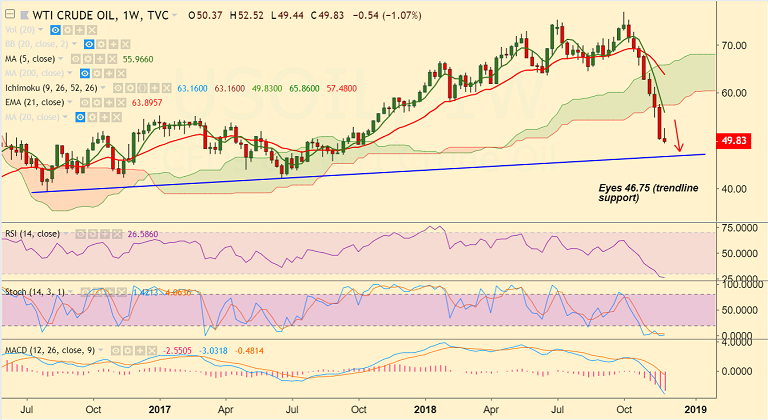

WTI chart on Trading View used for analysis

- WTI has breached the key $50 level to hit lowest since October 2017.

- The black gold was sold-off aggressively as markets remain skeptical ahead of the OPEC meeting next week.

- There are renewed concerns whether the OPEC will fail to deliver on the expected output cuts to stem the price declines and supply overhang.

- Also, increased cautiousness ahead of Friday’s Trump-Xi meeting on trade keeps the black gold on the defensive.

- Next bear target lies at 49.13 6th October 2017 lows. Further weakness could see 46.49 (Sept 2017 low).

- Immediate resistance is seen at 5-DMA at 50.85, Decisive break above 20-DMA to see some respite from bears.

Support levels - 49.13 (6th October 2017 lows), 46.75 (trendline), 46.49 (Sept 2017 low)

Resistance levels - 50.85 (5-DMA), 53.43 (50M SMA), 56.33 (21-EMA)

For details on FxWirePro's Currency Strength Index, visit http://www.fxwirepro.com/currencyindex.

Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures