In our recent technical write up, we’ve already stated that WTI crude prices are struggling to break out the stiff resistance from last couple of days. For more reading on this post, refer below weblink:

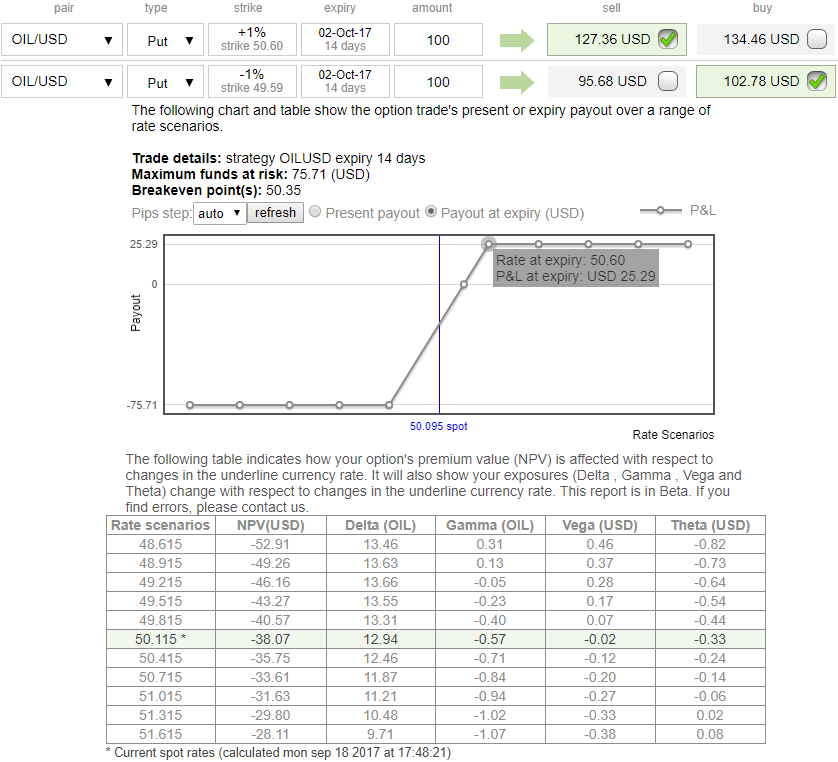

Capitalizing on puzzling rallies of WTI crude prices amid major downtrend, one can load up shorts in ITM puts as shown in the above diagram of credit put spread but preferably use this strategy with a narrowed strikes and tenors. While major downtrend could be arrested by the longs of the underlying pair with longer tenors.

The hedge funds and other speculative participants expurgated their bullish bets on U.S. crude futures and options in the week to Sept. 12, the U.S. CFTC reported on Friday.

Option strategy:

Well, contemplating momentary rallies, it is advisable to initiate Credit Put Spread (CPS) in order to tackle both short term upswings and major downtrend.

Usually, pondering over the option sensitivity tool, IVs and OTC indications these puzzling could be optimally tackled and attained the trade or investment objectives via theta options of shorter tenors. As we expect the retest of recent lows of 47.09 (where we see next strong support) or below in the weeks to come amid any abrupt upswings.

Option sellers can reap the benefits of a high Theta near expiry by selling short-dated ATM options with the expectation of little to almost no market movement. For ITM and OTM options as time to expiry draws nearer, Theta lowers and decreases. Well, in above case of diagonal credit put spreads, the strategy could be constructed at net credit, short leg would be absolutely at profits when underlying spot remains either at strikes chosen or at higher than strikes on expiration of short side.

Thereafter, the major trend prolongs to evidence further slumps, narrowed OTM longs would mitigate downside risks on the other hand as the holder of such option would be having right sell at predetermined strikes.

US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes