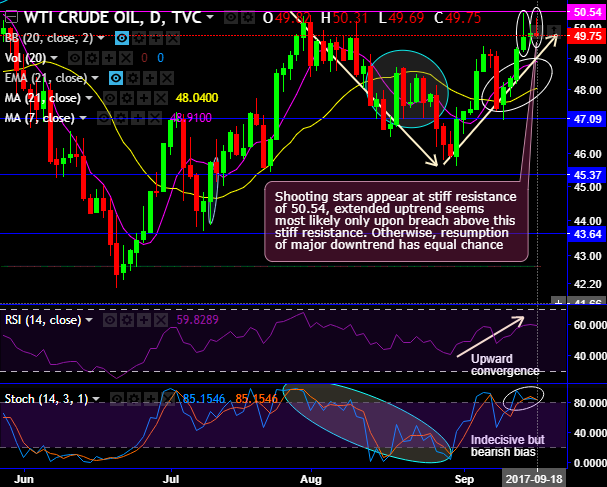

WTI crude prices have plummeted recent upswings, after rejecting stiff resistance level, although prices today have spiked upto 50.31, the bulls could not sustain the momentum in these price gains.

As a result, bears resume in the minor trend plummets below day open (49.82).

3 days in a row, the supply sentiments are observed and the upswings have been hampered at the same stiff resistance levels.

Shooting stars have occurred at 49.70, 49.80 and today the same bearish pattern is resembling at the moment. Historically, you could easily make out the rejection of rallies have happened at the same levels.

On a broader perspective, the consolidation phase in the major trend drifts in symmetric triangle pattern, tests resistance at downward trend line, consequently, the current prices slide below EMAs.

For now, although upswings are seen for the month, the buying sentiments are not coupled by both leading oscillators. The current prices are still below 21EMA despite this month’s rally.

RSI signals overbought pressures by evidencing the downward convergence to the price declines on monthly chart. While stochastic curves have also been converging downwards on this timeframes.

Overall, for the extension of the uptrend, it needs better clarity further.

We uphold our previous recommendation of shorts in WTI crude using mid-month tenors as the underlying price of this energy commodity may slide again upto 47.09 levels (next strong support), or even upto 45.37 levels upon breach below 1st target, maintain strict stop at $50.60 levels.

FxWirePro launches Absolute Return Managed Program. For more details, visit:

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings