As per the National Bank of Poland’s MPC, the latest minutes unpredictably indicated that several MPC members are willing to consider rate cuts. This comes as a surprise because individual interviews in recent months tended to show a rather complacent picture, with most MPC members asserting that strong growth and a tightening labour market all but rule out further monetary easing.

This appears to have changed following the weaker Q2 GDP reading and declining PMI in recent months. While the council as a whole still prefers stable rates, several members no longer exclude rate cuts in coming quarters if growth were to keep decelerating and deflation to continue. The base-case is for 50 bps lower rates than now by the end of this year.

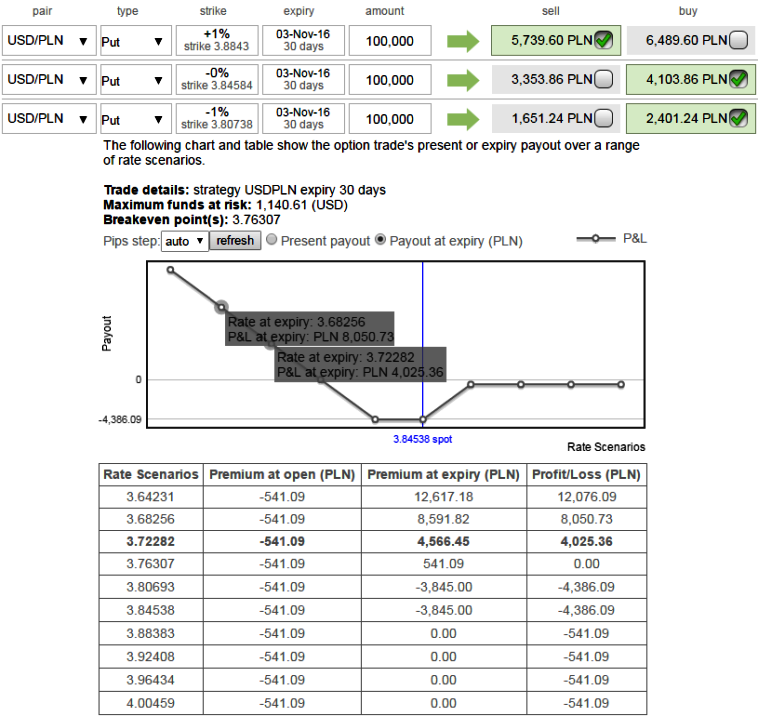

Currency Option Strategy: USDPLN Short Put Ladder

Rationale: Ever since the pair has hit the recent lows of 3.7998 levels, it has been showing little sense strength, but don’t be deceived by these rallies, we foresee more slumps in the months to come and hence, using such rallies optimally hedges further downside risks of this pair going forward with reduced cost.

Unlimited downside and limited upside profit potential, on daily technical charts the pair has been spiking higher and attempting to go beyond 21DMAs, but restrained at this levels, while the major downtrend would be taken by below option strategy.

Execution of the strategy: Short 1W (1%) ITM put option and simultaneously add longs on 1M ATM -0.49 delta put option and one more 2M (1%) OTM -0.35delta put option.

Please be noted that the tenors shown in the diagram is just for demonstration purpose only, use accurate tenor as stated above.

Maximum returns are limited to the extent of initial credit received if the USDPLN rallies above the upper breakeven point (BEP) but large unlimited profit can be achieved should the underlying exchange rate of USDPLN makes a vivid downswings below the lower BEP.

Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX  China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices  FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022  Bank of Japan Signals Cautious Path Toward Further Rate Hikes Amid Yen Weakness

Bank of Japan Signals Cautious Path Toward Further Rate Hikes Amid Yen Weakness  ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence

ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence